RBI Udgam Portal: Online Registration, Login, Check Unclaimed Deposits

RBI UDGAM portal Login, Rbi udgam portal unclaimed funds, Rbi udgam portal app, UDGAM portal RBI app download, UDGAM portal RBI registration, UDGAM RBI registration Online, RBI unclaimed deposits, UDGAM portal RBI link status, RBI Udgam Portal, Online Registration, Login, Check Unclaimed Deposits, RBI Udgam Portal 2025, RBI Udgam Portal Login, RBI Udgam Portal Registartion,

The Reserve Bank of India (RBI) has introduced a platform called UDGAM to help customers search for their unclaimed deposits and accounts. Currently, 30 banks are offering customers the ability to use the RBI UDGAM Portal, with additional banks in the process of onboarding. The platform, accessible online at udgam.rbi.org.in, allows registered customers to search for unclaimed deposits and accounts across multiple banks in a single, centralized location.

To assist depositors in navigating the Unclaimed Deposits Gateway, the RBI has also released a comprehensive list of frequently asked questions (FAQs). This guide is designed to help customers effectively use the UDGAM facility and access their unclaimed funds. For more details, depositors can visit the RBI UDGAM Portal.

Table of Contents

☰ Menu- What is RBI Udgam Portal ?

- RBI Udgam Portal Details in Highlights

- Benefits of RBI Udgam Portal

- Process to search unclaimed deposits of (a) individuals and (b) non-individuals on UDGAM portal

- Types of deposits/accounts covered in UDGAM Portal

- How to view deposit-related information

- What is the Unclaimed Deposit Reference Number (UDRN)?

- What Types of Accounts and Deposits Are Available Through the UDGAM Portal?

- Can Users Settle or Claim Unclaimed Deposits Through UDGAM?

- Does the UDGAM Portal Include All Banks? What Proportion of Unclaimed Deposits Do They Represent?

- Summary of RBI Udgam Portal Online Registration 2025

What is RBI Udgam Portal ?

The RBI Udgam Portal, launched by the Reserve Bank of India (RBI), stands for "Unified Deposits Gateway to Access Information for Unclaimed Money." It is an online platform designed to help individuals search for any unclaimed deposits they may have in various Indian banks, all in one place. UDGAM simplifies the process of locating unclaimed deposits, making it accessible for anyone who needs to check for any forgotten or unclaimed funds. The portal also includes deposits made by entities other than individuals, such as corporations.

RBI Udgam Portal Details in Highlights

| Portal Name | RBI Udgam Portal |

|---|---|

| Full Form | Unclaimed Deposits Gateway to Access Information |

| Launched By | RBI |

| Launched On | August 17, 2023 |

| Objective | To simplify the search for unclaimed deposits across multiple banks in one place. |

| Mode | Online |

| Beneficiaries | General Public |

| No. of Banks Involved | 30 banks |

| Official Website | udgam.rbi.org.in |

Benefits of RBI Udgam Portal

Here are the benefits of the RBI Udgam Portal:

- Centralized Search: UDGAM allows registered users to easily search for unclaimed deposits and accounts across multiple banks from a single platform. To claim the funds, users must contact the respective bank holding the deposit.

- Wide Coverage: Currently, 30 banks, covering around 90% of India’s unclaimed deposits, are part of UDGAM. More banks are expected to join in the future.

- Unique Reference Number (UDRN): Each unclaimed account is assigned a unique reference number, ensuring that the identity of the bank branch or account holder remains confidential, thus safeguarding privacy.

Process to search unclaimed deposits of (a) individuals and (b) non-individuals on UDGAM portal

To search for unclaimed deposits on the UDGAM portal, users must first register by providing their mobile number and name. A detailed user manual is available on the portal at https://udgam.rbi.org.in/unclaimed-deposits/#/login, which guides users through the registration process and how to search for unclaimed deposits.

For Individuals: To search for unclaimed deposits under the individual category, users must input details about the account holder, including the name of the bank (up to five banks can be selected). Additionally, they need to provide one or more of the following identifiers: date of birth, PAN (Permanent Account Number), driving license number, voter ID number, or passport number.

For Non-Individuals (Entities): For non-individual accounts, users must enter four key details: the name of the authorized signatory, PAN, Corporate Identification Number (CIN), and the date of incorporation. Optionally, users may also provide the name of the entity and the bank.

In case none of the listed details are available, users can still search by entering the address of the entity (for non-individuals) or the account holder's address (for individuals), as an alternative to the required inputs.

Types of deposits/accounts covered in UDGAM Portal

The UDGAM platform allows users to search all unclaimed deposits and accounts included in the RBI’s Depositor Education and Awareness (DEA) Fund. The accounts includes following:

- Savings bank deposit accounts

- Current deposit accounts

- Fixed or term deposit accounts

- Cash credit accounts

- Cumulative/recurring deposit accounts

- Other deposit accounts in any form or with any name

- Loan accounts after due appropriation by the banks

- Margin money against issue of letter of credit/guarantee etc., or any security deposit

- Outstanding telegraphic transfers, bankers’ cheques, demand drafts, mail transfers, pay orders, inter-bank clearing adjustments, sundry deposit accounts, vostro accounts, unadjusted national electronic funds transfer (Neft) credit balances and other such transitory accounts, unreconciled credit balances on account of automated teller machine (ATM) transactions, etc.

- Balances that are still unpaid on any bank-issued prepaid card, but not amounts owed on traveller’s checks or other similar instruments with no maturity period.

- Rupee gains on foreign currency deposits held by banks following their conversion to rupees in compliance with current foreign exchange laws and

- Any further sums that the reserve bank may from time to time specify.

How to view deposit-related information

To view deposit-related information for unclaimed deposits, follow the steps outlined below:

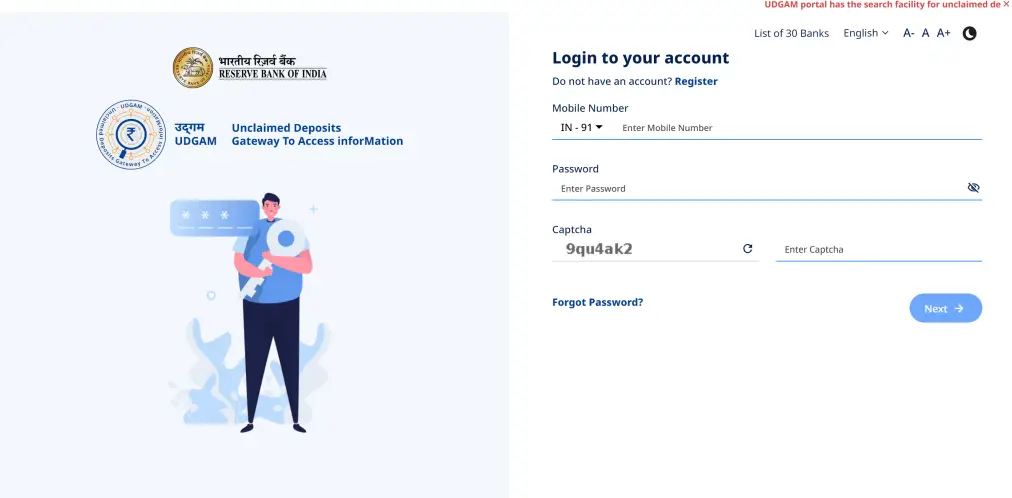

- Log into the Portal: Start by visiting the website and logging in to the portal.

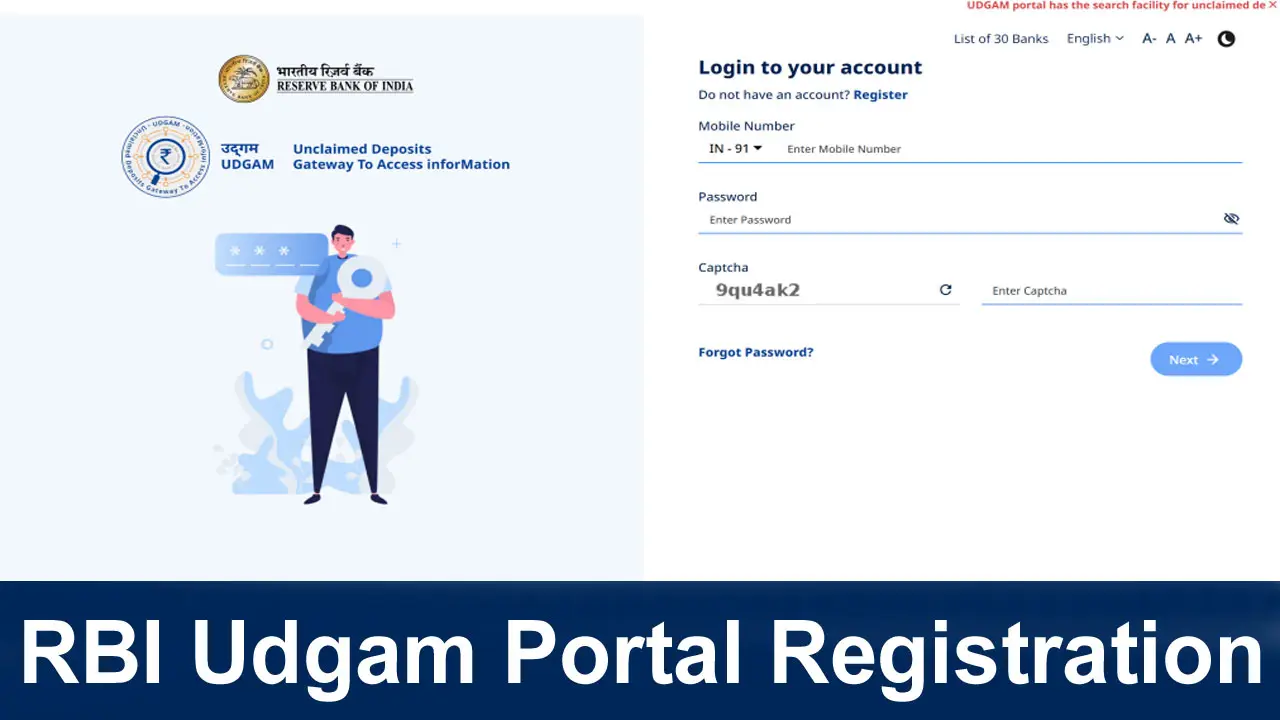

- Create an Account: To access the information, you must first create an account. During the registration process, you will need to provide the depositor’s details, such as mobile number, first and last names, password, and captcha code.

- Agree to Terms: After entering your information, you must check the boxes indicating that you agree to the privacy policy and disclaimer, and that you are using the site for legal purposes.

- Complete Registration: Once you've successfully registered, you can log in to the portal using the credentials you provided.

- Search for Unclaimed Deposits: After logging in, you can search for unclaimed deposits in any of the 30 banks whose information is compiled on the portal.

What is the Unclaimed Deposit Reference Number (UDRN)?

Each unclaimed account or deposit transferred to the RBI’s DEA Fund is assigned a unique identifier called the Unclaimed Deposit Reference Number (UDRN). This number is generated by banks using the Core Banking Solution (CBS). The UDRN ensures that third parties cannot access specific details about the account holder or bank branch. After conducting a successful search on the UDGAM portal, users can use the UDRN to easily claim their deposits from the relevant bank branch. All 30 participating banks have implemented the necessary procedures to generate UDRNs for unclaimed deposits.

What Types of Accounts and Deposits Are Available Through the UDGAM Portal?

The UDGAM portal provides access to unclaimed deposits and accounts that are part of the RBI’s Depositor Education and Awareness (DEA) Fund. These include various types of accounts and deposits from the participating banks.

Can Users Settle or Claim Unclaimed Deposits Through UDGAM?

No, the UDGAM portal does not provide an option to settle or claim unclaimed deposits directly. Its primary functions are to:

- Allow users to search for unclaimed deposits and accounts across several banks.

- Provide information on the claim and settlement procedures for each bank.

To claim an unclaimed deposit, users must contact the respective bank directly.

Does the UDGAM Portal Include All Banks? What Proportion of Unclaimed Deposits Do They Represent?

No, not all banks are part of the UDGAM portal. As of March 4, 2024, thirty banks participate in the portal, representing around 90% of the value of unclaimed deposits in the RBI’s Depositor Education and Awareness (DEA) Fund. The list of these participating banks is available on the UDGAM homepage (UDGAM Portal). Onboarding of additional banks is in progress.

Summary of RBI Udgam Portal Online Registration 2025

The RBI Udgam Portal allows users to search for unclaimed deposits across multiple banks. To register, users must provide their mobile number, name, and create a password. After registration, they can log in and search for unclaimed deposits by entering account details. A user manual is available on the portal to guide through the process.

What is the RBI Udgam Portal?

The RBI Udgam Portal is an online platform for searching unclaimed deposits across multiple banks in India.

Who can use the RBI Udgam Portal?

The portal is available to the general public, allowing them to search for unclaimed deposits.

How many banks are involved in the Udgam Portal?

Currently, 30 banks are part of the portal, covering around 90% of unclaimed deposits.

What types of deposits can be searched?

Users can search for savings, current, fixed, and term deposit accounts, among others.

How do I register on the portal?

To register, users must provide their mobile number, name, and create a password.

Can I claim unclaimed deposits through the Udgam Portal?

No, the portal only allows users to search for unclaimed deposits; claims must be made directly with the respective banks.

What is the Unclaimed Deposit Reference Number (UDRN)?

UDRN is a unique number assigned to each unclaimed deposit for privacy and identification purposes.

Is the portal accessible to non-individual entities?

Yes, both individuals and non-individuals (corporations, entities) can search for unclaimed deposits.

Can I search unclaimed deposits by address?

Yes, if other details are unavailable, users can search using the account holder’s or entity’s address.

What is the official website of the RBI Udgam Portal?

The official website is https://udgam.rbi.org.in.

What is the UDGAM Portal?

The UDGAM (Unclaimed Deposits-Gateway to Access Information) portal is a web platform developed by the Reserve Bank of India (RBI). It allows registered users to centrally search for unclaimed deposits and accounts across multiple banks from one location, making the process more convenient.

Does the user have the option to settle or claim their unclaimed deposits through the RBI or the UDGAM portal?

No, the only two things that the UDGAM portal makes easier are (a) searching for unclaimed deposits or accounts across several banks in one location and (b) giving information on each bank’s claim and settlement procedures (which is what the search results will show). Only the corresponding bank may be contacted about unclaimed deposits.

Telegram

Telegram

Comments Shared by People