Check Your EPF Statement Online – Step-by-Step Full Guide

An Employees' Provident Fund (EPF) statement is a passbook that records the monthly contributions made by both the employer and the employee, along with the amount allocated towards the pension scheme. It also includes the interest credited to the employee's EPF account. To make accessing EPF statements easier, the Employees' Provident Fund Organisation (EPFO) has introduced a user-friendly online platform, allowing individuals to conveniently retrieve their EPF statements with just a few clicks.

Table of Contents

☰ Menu- EPF Statement 2025

- Employees Provident Fund Statement Details in Highlights

- Check Your EPF Statement Online in India

- Open the EPFO Portal and register

- Make Your Universal Account Number (UAN) active

- Open the UAN Member Portal and log in

- Get Your EPF Statement

- Examining and downloading the statement from the EPF

- Comprehending the EPF Disclosure

- How to maximise your workers’ provident fund

- Summary of Check Your EPF Statement Online

EPF Statement 2025

The EPF Statement 2025 provides a detailed record of your approved advances, settlements, transfer-in, and transfer-out transactions across various Indian companies where you've worked. It serves as an online version of your PF status, much like an e-passbook. This statement, or e-passbook, will display all transactions on a given day and summarize them by month. It includes personal details such as your name and birthdate, along with the most up-to-date status of your Provident Fund account.

ESIC – Employee State Insurance

Employees Provident Fund Statement Details in Highlights

| Scheme Name | EPF Statement |

|---|---|

| Full Form | Employees Provident Fund |

| Objective | To make EPF statement easily accessible to employees |

| Mode | Online |

| Official Website | www.epfindia.gov.in |

Check Your EPF Statement Online in India

Follow the steps below to check your EPF statement online in India

Open the EPFO Portal and register

Here is a step-by-step guide for registering on the EPFO portal:

- Open the EPFO Portal: Visit the official EPFO website at www.epfindia.gov.in.

- Navigate to the Employee Section: On the homepage, look for the tab labeled “For Employees” and click on it.

- Go to Member Services: Under the “Services” tab, click on the option labeled “Member UAN/Online Services.”

- Access the UAN Member Portal: This will direct you to the UAN Member Portal. If you are a new user and haven't registered your UAN (Universal Account Number), click on the “Activate UAN” option.

- Activate Your UAN: To activate your UAN, you will need to provide your details like your UAN number, Member ID, Aadhaar number, etc.

Once you complete the activation process, you can access your EPF statement and other related services.

Make Your Universal Account Number (UAN) active

Here are the steps to activate your Universal Account Number (UAN) and complete the registration process:

- Enter Your Details: On the EPFO portal, provide your Member ID, Mobile Number, and UAN (Universal Account Number).

- Request Authorization Pin: Click on the option to get the Authorization Pin.

- Receive OTP: An OTP (One-Time Password) will be sent to your registered mobile number. Enter this OTP in the provided field.

- Submit the OTP: After entering the OTP, click on the "Submit" button.

- Set Your Password: Once the OTP is successfully validated, you'll be prompted to set a password for your UAN account.

- Complete Registration: Finish the registration process by confirming your details and setting up the password.

After completing these steps, your UAN will be active, and you will have full access to your EPF services.

Open the UAN Member Portal and log in

Here are the steps to log in to the UAN Member Portal after your UAN has been activated:

- Go to the UAN Member Portal: Visit the UAN Member Portal again at www.epfindia.gov.in.

- Enter Your Login Details: On the login page, enter your UAN (Universal Account Number) and the password you set during the registration process.

- Captcha Code: Enter the captcha code displayed on the screen to verify that you are a human.

- Sign In: After filling in the required details, click on the “Sign In” button to access your EPF account.

Once logged in, you can check your EPF balance, view statements, and access other services.

E Shram Card Payment Status Check

Get Your EPF Statement

Here are the steps to get your EPF statement:

- Access the Dashboard: After logging in to the UAN Member Portal, you’ll be directed to your account dashboard where various EPF account-related options are available.

- Select "View" from the "Passbook" Menu: In the dashboard, look for the “Passbook” section and click on the “View” option.

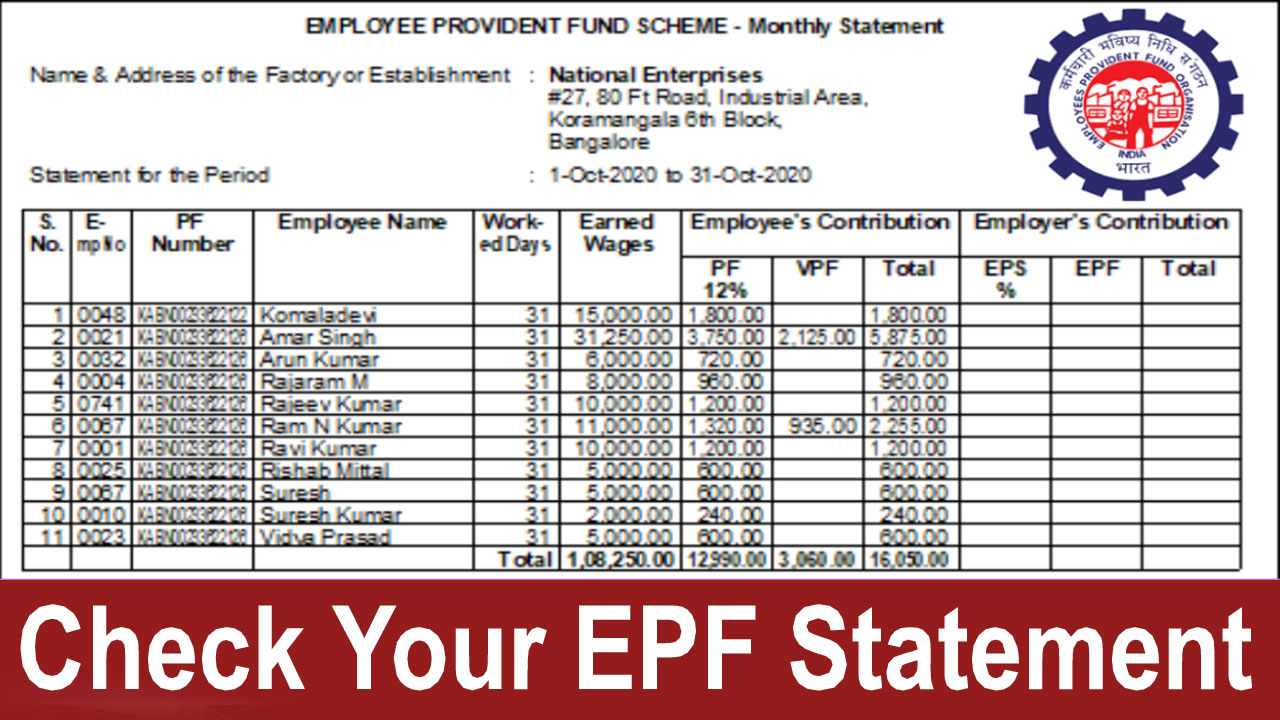

- Check Your EPF Statement: Your EPF statement, also referred to as the passbook, will display detailed information such as:

- Employer’s Contributions

- Employee’s Contributions

- Interest Earned

- Other Contribution Information

You can review all transactions made to your EPF account for the specified period.

Examining and downloading the statement from the EPF

Here are the steps to examine and download your EPF statement:

- View Contribution Details: In the EPF statement section, you can select the fiscal year for which you want to view your contribution details.

- Click "Download": After selecting the desired fiscal year, click on the “Download” button.

- Choose Format: You will be given the option to download the statement in two formats:

- Excel

- Save the Statement: Once you choose your preferred format, the statement will be downloaded to your device for your records.

Comprehending the EPF Disclosure

The EPF statement provides a detailed breakdown of your account's activity. Here’s what you can comprehend from the EPF disclosure:

- Interest Earnings and Contributions: The statement provides a comprehensive summary of the interest earned on your contributions, as well as the contributions made by both you (the employee) and your employer.

- Opening and Closing Balances: For the selected fiscal year, the opening balance (beginning of the year) and the closing balance (end of the year) are clearly shown.

- Employer Contributions: The statement highlights the contributions made by your employer to your EPF account during the fiscal year.

- Interest Credited by EPFO: You will also see the interest credited by the EPFO to your account, reflecting the growth of your EPF balance over time.

This disclosure helps you track the progress of your EPF account and understand how both your contributions and interest accumulate throughout the year.

How to maximise your workers’ provident fund

Maximizing your Employees’ Provident Fund (EPF) is an excellent way to ensure financial stability post-retirement. Here are some strategies to optimize your EPF and enhance your retirement savings:

- Contribute More Than 12%: You can choose to contribute more than the mandatory 12% of your salary to the EPF by opting for a Voluntary Provident Fund (VPF). This additional contribution helps in building a larger retirement corpus and offers a higher interest rate. The VPF is a low-risk investment, making it a smart choice for long-term wealth accumulation.

- Withdraw EPF After Retirement: After retirement, it is advisable to withdraw the accumulated EPF balance. This allows you to utilize the funds for other investments or financial needs. By making larger contributions during your working years, you can ensure a healthy return on your EPF balance.

- Transfer EPF When Changing Jobs: When switching employers, ensure that you transfer your EPF balance from your old employer’s account to the new employer’s account. This ensures continuity in your savings and prevents any disruptions in your retirement corpus. It's your responsibility to ensure that the transfer happens smoothly, but you can always track the process by checking your EPF statement online.

- Obtain Your Universal Account Number (UAN): The Universal Account Number (UAN) is essential for simplifying the transfer of your EPF balance from one employer to another. Having a UAN makes managing multiple EPF accounts easier and more efficient. It also enables you to track and manage your EPF details online, giving you full visibility of your retirement savings.

- Monitor Your EPF Regularly: To ensure that your contributions are being accurately credited, download and regularly check your EPF statement online. This helps you keep track of the balance, contributions, and interest credited to your account. Routine monitoring helps you stay on top of your savings and spot any discrepancies early.

By taking these steps, you can significantly enhance the growth of your Employees’ Provident Fund, ensuring a more secure financial future.

How To Link NPS Account with Aadhaar Card

Summary of Check Your EPF Statement Online

To check your EPF statement online, visit the EPFO portal and register with your Universal Account Number (UAN). Once registered, log in to the UAN Member Portal, navigate to the "Passbook" section, and click "View." You can then access and download your EPF statement in PDF or Excel format, showing contributions and interest details.

What is an EPF statement?

An EPF statement is a record of your contributions, including those from your employer, and the interest earned on your Employees' Provident Fund (EPF) account.

How can I check my EPF statement online?

You can check your EPF statement through the EPFO portal by logging into the UAN Member Portal.

What is UAN?

UAN (Universal Account Number) is a unique number assigned to each EPF member, enabling easy access to EPF services.

How do I activate my UAN?

Visit the EPFO portal, enter your Member ID and details, and complete the OTP verification to activate your UAN.

What details are included in the EPF statement?

The statement includes your contributions, employer contributions, interest credited, and the opening and closing balances for the selected period.

Can I download my EPF statement?

Yes, you can download your EPF statement in PDF or Excel format from the UAN Member Portal.

Is it necessary to register on the EPFO portal?

Yes, registration and UAN activation are necessary to access and view your EPF statement online.

What if I forget my UAN password?

You can reset your UAN password through the EPFO portal using your registered mobile number and OTP.

Can I check multiple EPF accounts?

Yes, using your UAN, you can access and check the EPF statement for multiple accounts across different employers.

How often is the EPF statement updated?

The EPF statement is typically updated monthly, reflecting contributions, interest, and any other transactions.

What is the statement for the EPF account?

The EPF statement or passbook will break down the monthly contributions made by the employer and employee in rupees. The sum allotted to the Employees’ Pension Scheme, or EPS, is also mentioned separately in the declaration.

Is it free to check my EPF statement?

Yes, it is free for you to view your EPF statement.

What is a voluntary provident fund about?

Employees may donate more to the voluntary provident fund than the minimum 12 percent needed for provident fund contributions, it is indicated under the ‘Voluntary Provident Fund’ column. Individual voluntary gifts made by employees are displayed. It is important to keep in mind that the employer is not obligated to match the VPF payment. Hence, a number may not be sent.

Telegram

Telegram

Comments Shared by People