TGLI Missing Credits 2025 Status, Form PDF, How to Clear and Avoid policy missing credits

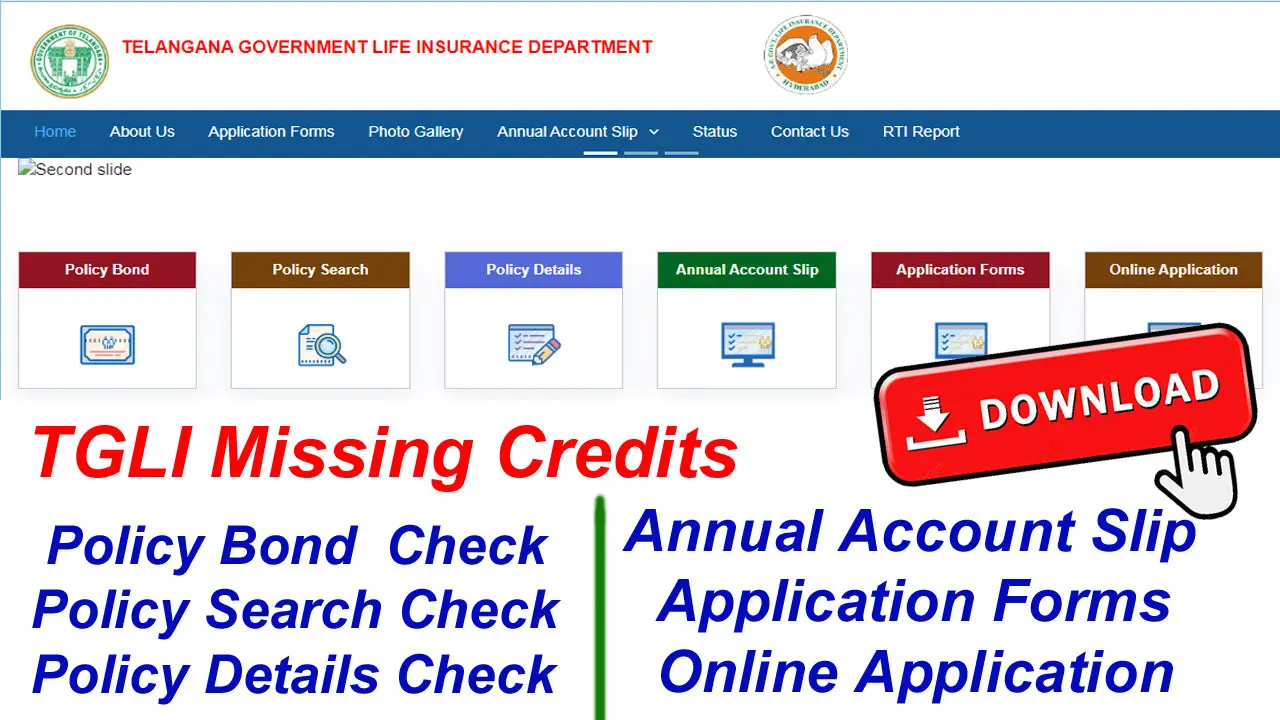

Tsgli missing credits status check, Tsgli missing credits online, TSGLI Missing Credits Proforma, Tsgli missing credits amount, TSGLI Missing credits Proforma pdf, Tsgli missing credits 2025, Policy Bond, Policy Search, Policy Details, Annual Account Slip, Application Forms, ONLINE Application, Status, RTI Report, TGLI Missing Credits 2025 Status, Form PDF, How to Clear and Avoid policy missing credits,

TSGLI (Telangana State Government Life Insurance) missing credits refer to discrepancies in the insurance accounts of Telangana State Government employees, where the premium payments made for their life insurance policies do not reflect correctly. This situation can arise due to various reasons, including errors in personal information, incorrect policy numbers, or issues with the banking system that processes these payments.

For employees enrolled in the TSGLI scheme, missing credits can lead to significant problems, such as lapses in insurance coverage and financial instability in case of unforeseen events. Understanding the nature of missing credits is crucial for policyholders, as it directly impacts their insurance status. The TSGLI scheme provides life insurance policies exclusively for government employees, with specific guidelines in place to ensure proper maintenance of these accounts.

Missing credits can stem from clerical errors during the documentation process, failure to update personal information, or discrepancies in the records maintained by the Drawing and Disbursing Officer (DDO). To avoid lapses in coverage and ensure continuous benefits under the TSGLI scheme, employees must stay vigilant about their policy details and payment statuses. Regularly verifying premium payments and personal information can help identify and rectify issues before they lead to significant consequences.

The TSGLI Department emphasizes the importance of submitting accurate documentation and encourages employees to be proactive in resolving any discrepancies that may arise. By understanding and addressing missing credits, policyholders can maintain uninterrupted life insurance coverage and secure their financial future.

Table of Contents

☰ Menu- TGLI Missing Credits 2025

- About TGLI Missing Credits 2025

- Cadre Strength

- Functions of the Directorate

- Functions of the District Insurance Office

- Sailent Features

- Slab Rates

- Issue of Policies

- Remittance of Premiums

- Duplicate Policy Bond

- Benefits of the TGLI Scheme

- What Are TSGLI Missing Credits?

- Key Features of the TGLI Scheme

- TGLI Eligibility Criteria

- How to Apply for the TGLI Scheme

- TGLI Missing Credits Policy Bond Download

- How To Search TGLI Missing Credits Policy Number

- Steps to Clear TSGLI Missing Credits 2025

- How to Avoid TSGLI Missing Credits

- TGLI Missing Credits Policy Details

- How to Download TGLI Missing Credits Annual Account Slip

- How to Download TGLI Missing Credits Application Forms

- How to Check TGLI Missing Credits Status Online

- How to Download TGLI Missing Credits RTI Report

- Tsgli missing credits proforma pdf download

- Tips for Filling Out the TGLI Missing Credits Proforma

- Why is the TGLI Missing Credits Proforma Important?

- What is the TGLI Missing Credits Proforma?

- TGLI Missing Credits Important Links

TGLI Missing Credits 2025

In 2025, TSGLI (Telangana State Government Life Insurance) missing credits remain a critical concern for Telangana State Government employees enrolled in the life insurance scheme. Missing credits occur when the premiums paid by policyholders do not get accurately recorded in their insurance accounts, leading to potential lapses in coverage and affecting the overall benefits of the policy. These discrepancies can arise due to several factors, including clerical errors, incorrect personal information, or issues with the banking process through which the payments are made.

The TSGLI Department has highlighted the importance of maintaining accurate records to prevent missing credits. As part of its initiative, the department provides detailed guidelines to help employees understand how to address and avoid these issues effectively. Policyholders are encouraged to verify their premium payment records regularly and ensure that their personal information and policy numbers are correctly documented. This vigilance helps in preventing discrepancies that could lead to financial losses or disruptions in insurance coverage.

To clear missing credits, employees must follow specific procedures outlined by the TSGLI Department, including submitting detailed posting information and ensuring that all required documentation is correctly attested by the Drawing and Disbursing Officer (DDO). The 2025 guidelines emphasize the importance of accuracy in maintaining insurance accounts and provide steps to remedy any missing credits promptly.

About TGLI Missing Credits 2025

- The Director of Insurance is the Head of the Department.

- The Director is assisted by the Joint Directors, Deputy Directors, Assistant Directors followed by non Gazetted Officers and Office Sub Ordinates.

Cadre Strength

| S.No | Name of the Category | Cadre Strength |

| 1 | Director | 01 |

| 2 | Joint Director | 03 |

| 3 | Deputy Director | 02 |

| 4 | Asst. Director | 12 |

| 5 | Private Secretary to Director of Insurance | 01 |

| 6 | Superintendent | 40 |

| 7 | Senior Accountant | 129 |

| 8 | Junior Accountant | 30 |

| 9 | Bradma Operator | 01 |

| 10 | Telephone Operator | 01 |

| 11 | Lift Operator | 02 |

| 12 | Electrician | 02 |

| 13 | Cashier | 03 |

| 14 | Driver | 01 |

| 15 | Record Assistant | 01 |

| 16 | Dafedar | 01 |

| 17 | Office Subordinates | 23 |

| 18 | Chowkidar | 01 |

| Total | 258 |

Functions of the Directorate

- Supervision of District Insurance Offices.

- Consolidation and Submission of budget estimates and distribution of budget under management expenses, loans and claims.

- Review of progress made by District Insurance Offices.

- Printing and supply of departmental forms and stationery articles.

- Evolving procedures, modifications, deletions, etc...

- Issue of clarifications/guidelines to DIO’s.

- Implementation of Government orders issued from time to time.

- Preparation of Proforma Accounts and Movement Schedule work.

- Declaration of bonus.

- Administration of Telangana State Employees Group Insurance Scheme.

- Maintenance of Insurance building complex.

Functions of the District Insurance Office

- Issue of Policies.

- Posting of Schedule Premiums.

- Sanction of Loans.

- Settlement of Claims.

- Preparation of data for Proforma Accounts, Reserve Accounts, Movement Schedule work for declaration of bonus.

Sailent Features

- The Government employees who are between 19 and 56 years of age are eligible for taking TSGLI Policies.

- The TSGLI Department issues only Endowment Policies which mature one day before attaining(58) years of age.

- TSGLI policies do not lapse.

- The Premium rates are low.

- TSGLI Premium is exempted from income tax under section 80C.

- Attractive Bonus rates.

- The present rate of Bonus is Rs 100/- for every Rs 1000/- Sum Assured per annum.

- The Loans are sanctioned up to 90% of Surrender Value.

- Only Simple Interest of 9% per annum is charged against loans sanctioned.

- In case of maturity of the policy, the total Sum Assured and Bonus till Date of Maturity are paid to the policy holder.

- If the Policy Holder ceases to be Government servant, and decides to surrender the policy by discontinuing the payment of Premium, the subscriber will be paid the Surrender Value and the eligible Bonus.

- In case of Death of policy holder before maturity of the policy, the full Sum Assured along with Bonus till date of death are paid to the legal heirs.

Slab Rates

The following are the compulsory Premium Slab Rates:

| Pay Slabs (In Rupees) | Compulsory Premium Rate (In Rupees) |

| 19000-24280 | 750 |

| 24281-31040 | 1000 |

| 31041-42300 | 1250 |

| 42301-51320 | 1700 |

| 51321-71000 | 2000 |

| 71001-162070 | 3000 |

Issue of Policies

- After deduction of first Premium, the employee has to fill up and submit a proposal form duly signed and attested by his/her DDO/Head of office for obtaining TSGLI policy.

- In respect of second or subsequent policies also, the policy holder has to submit proposal forms and obtain subsequent policies.

- Only premium payment without submission of proposal form will not give any risk coverage or monetary benefit to the subscriber and such payments will be treated as unauthorized amounts which will be refunded on application with out any interest or bonus.

- Employees who have completed (56) years of age are not eligible to take TSGLI policies(first or subsequent).

- Proposals submitted after(56) years of age will not be considered for issue of policies even if premiums are paid prior to 56 years of age.

Remittance of Premiums

1. Head of the Account of TSGLI Department:

- 8011-105-01.

- Major Head 8011 – Insurance and Pension Funds.

- MH 105 – State Government Insurance Fund.

- SH (01) – Telangana State Government Life Insurance Fund.

2. The premium is recovered at source in the salary bills of the employees and the details are sent through schedules.

3. The employees whose salaries are not paid through Treasury/PAO and who have to pay the premium through Challan have to credit the premium to the above head of the account.

4. Please quote the department service head and also DDO number in the Challan.

Duplicate Policy Bond

- The employee has to request his/her DDO to deduct One rupee extra in addition to regular premium in the salary schedules for one time only.

- After deduction, the employee has to submit a declaration form on a paper stating that he/she has lost the policy or the policy is destroyed and that he/she has not mortgaged the policy anywhere. This declaration has to be signed by him/her and attested by DDO / Head of the Office.

- The employee has to submit the above declaration form along with the copy of the monthly schedule to the respective District Insurance Office for obtaining the duplicate policy.

Benefits of the TGLI Scheme

The TGLI scheme offers several significant benefits to employees and their families:

- Financial Security: Provides essential financial support to the employee’s family in case of their untimely death.

- Maturity Benefit: Ensures the employee a lump sum payout upon retirement age or turning 58.

- Annual Bonus: Rewards policyholders with a bonus for every year of completed service.

What Are TSGLI Missing Credits?

TSGLI missing credits refer to the situation where premium payments made by Telangana State Government employees are not accurately reflected in their respective insurance accounts. This issue can lead to significant complications, including lapses in life insurance coverage, making it essential for policyholders to address these discrepancies promptly.

Several factors can contribute to missing credits. Errors in personal information, such as misspellings of names or incorrect details in the records, can hinder the proper posting of premium payments. Additionally, incorrect policy numbers can lead to premiums being allocated to the wrong accounts, thereby preventing the intended beneficiaries from receiving the benefits of their policies.

Moreover, problems related to the bank’s payment processing system can also cause delays or errors in recording payments. For instance, if a payment is not processed in a timely manner or if there are transaction errors, the premium may not reflect in the insurance account as expected.

To maintain continuous life insurance coverage under the TSGLI scheme, it is crucial for policyholders to ensure that their premium payments are posted accurately. Regularly verifying personal information, policy numbers, and payment confirmations can help prevent the occurrence of missing credits. Addressing these issues proactively ensures that employees are safeguarded under the TSGLI scheme without any interruptions in their insurance coverage.

Key Features of the TGLI Scheme

- Premium Calculation: The TGLI premium is tailored to the individual employee, taking into account factors such as age, salary, and the chosen assured sum. Premiums are conveniently deducted monthly from the employee's salary, ensuring a seamless payment process.

- Sum Assured: The sum assured represents the financial amount payable to the employee’s beneficiaries in the unfortunate event of their demise. This amount is determined by considering the employee's salary and length of service, providing adequate financial protection for their family.

- Bonus: Employees enrolled in the TGLI scheme are eligible to receive an annual bonus for each completed year of service. The bonus is calculated based on the sum assured and the duration of service, adding an additional layer of financial benefit over time.

- Maturity Benefit: Upon reaching the age of 58 or upon retirement—whichever occurs first—policyholders are entitled to a maturity benefit. This payout is calculated based on the sum assured along with the total years of service, rewarding long-term commitment to the scheme.

- Surrender Value: Should an employee choose to surrender their policy before maturity, they are entitled to a surrender value. This value is influenced by both the sum assured and the length of service, ensuring that employees have a financial safety net even if they decide to exit the scheme early.

These features make the TGLI scheme a comprehensive and supportive life insurance option for Telangana State Government employees, ensuring financial security for themselves and their families.

TGLI Eligibility Criteria

To be eligible for the TGLI scheme, the following criteria must be met:

- Employment: The scheme is available to all Telangana State Government employees, including those in regular, temporary, and part-time positions.

- Age: Employees must be between 21 and 53 years of age to enroll in the TGLI scheme.

- Service Requirement: A minimum of one year of service is required to be eligible for the scheme.

How to Apply for the TGLI Scheme

Applying for the TGLI scheme is straightforward. Here’s a step-by-step guide:

- Download the Application Form: Obtain the application form from the official Telangana State Government website.

- Fill in Required Details: Complete the form with personal information, nominee details, and bank account information.

- Attach Necessary Documents: Include copies of your salary slip, age proof, and service certificate.

- Submit the Application: Submit the completed form and the attached documents to the nearest TGLI office.

TGLI Missing Credits Policy Bond Download

- Go To Website: First of all, go to the TSGLI (Telangana State Government Life Insurance official website i.e., http://tgli.telangana.gov.in/. And click on the link "Policy Bond" given in the home page.

- Enter the Correct Policy Number: Ensure that you input your TSGLI policy number accurately. This is crucial as any mistakes will prevent the system from locating your policy details.

- Select the Suffix: After entering your policy number, select the appropriate suffix from the dropdown menu (e.g., A, B, C, D, E, F). The suffix helps in identifying the specific policy variant linked to your account.

- Click on the "Get Policy Bond" Button: Instead of pressing the "Enter" key, click directly on the "Get Policy Bond" button. This step is important to initiate the download process without errors.

- Check Your Internet Speed: The time it takes to download the policy bond may vary based on your internet connectivity. Ensure that you have a stable and fast internet connection to minimize delays in the download process.

By following these tips, you can efficiently download your TGLI missing credits policy bond and ensure that you have the necessary documentation to address any discrepancies in your insurance account.

How To Search TGLI Missing Credits Policy Number

Retrieving your TSGLI (Telangana State Government Life Insurance) policy number is essential for addressing any missing credits in your account. Follow these steps to efficiently search for your policy number:

- Go To Website: First of all, go to the TSGLI (Telangana State Government Life Insurance official website i.e., http://tgli.telangana.gov.in/. And click on the link "SEARCH POLICY" given in the home page.

- Enter Part of Your Name: Begin by entering a part of your name in the designated field. For instance, if your name is Karthik, you can type "Karthik" followed by a wildcard character like %. This allows the system to search for any records associated with your name.

- Input Wildcard Character: In the next field, enter % alone. This further broadens the search to include all possible matches related to your name and ensures you do not miss any potential entries.

- Select Date of Birth: Choose your date of birth from the provided date selection options. This step helps narrow down the search results, making it easier to locate your specific policy number.

- Click on "Retrieve Policy No." Button: After filling in the required information, click the "Retrieve Policy No." button. This action prompts the system to search through the database and display a list of matching entries.

- View Your Policy Number: Below the button, you will see a list of details that include your policy number. Review the list carefully to find your specific policy number associated with your account.

By following these steps, you can easily retrieve your TSGLI policy number, allowing you to address any issues related to missing credits and maintain accurate records for your insurance policy.

Steps to Clear TSGLI Missing Credits 2025

Clearing missing credits in your Telangana State Government Life Insurance (TSGLI) account is essential to ensure that your insurance coverage remains uninterrupted. Here’s a step-by-step guide to help you resolve any discrepancies effectively:

Submit Posting Details:

- Gather and provide your posting details, which should include the month of the premium payment, the TSGLI premium amount or loan installment, the token number or voucher number, and the total amount of the TSGLI schedule.

- It’s important that these details are attested by your Drawing and Disbursing Officer (DDO) to validate your submission.

Challan Remittance:

- If you made your payment through a challan, ensure you submit the relevant posting details. This includes the month of payment, the premium amount or loan installment, the challan number, the challan amount, and the payment date.

- Like the posting details, this information must also be accompanied by attested documentation from the DDO to confirm the payment.

Include Full Policy Details:

- Make sure to include complete details of your policy numbers along with the names of the employees for whom the challan was paid.

- Providing accurate policy information helps the TSGLI department process your request more efficiently and reduces the likelihood of further discrepancies.

By meticulously following these steps, you can effectively clear any missing credits in your TSGLI account, ensuring that your life insurance coverage continues without any lapses. Always retain copies of your submissions and documentation for your records.

How to Avoid TSGLI Missing Credits

Preventing missing credits in your Telangana State Government Life Insurance (TSGLI) account is crucial for maintaining seamless insurance coverage. Here are some effective strategies to avoid these discrepancies in the future:

Verify Policy Numbers:

Drawing and Disbursing Officers (DDOs) should consistently verify the accuracy of TSGLI policy numbers listed in the schedules against the department’s official policy bonds. Any errors in policy numbers can lead to missing credits, as premiums may not be accurately posted to individual accounts.

Consistent Recording:

Once the correct policy numbers are recorded in the schedules, they should remain consistent each month. It’s advisable for employees to verify their TSGLI policy numbers at least once a year to catch any discrepancies early and ensure ongoing accuracy.

Permanent Record in Service Register:

To maintain easy access and reference, employees should record their TSGLI policy numbers on the first page of their Service Register (SR). This creates a permanent record that can be referred to when needed, minimizing the chances of miscommunication or errors.

Update Missing Credits Promptly:

If any credits are identified as missing, DDOs should consider delegating establishment staff to the respective District Insurance Office. This can expedite the process of updating any missing premiums, ensuring that the necessary corrections are made swiftly.

By implementing these preventive measures, Telangana State Government employees can significantly reduce the risk of encountering missing credits in their TSGLI accounts. Policyholders are encouraged to stay proactive by regularly verifying policy details and submitting accurate information promptly. Following the guidelines set by the TSGLI Department can lead to a smoother experience and uninterrupted life insurance coverage.

TGLI Missing Credits Policy Details

To effectively manage and prevent missing credits in the TSGLI (Telangana State Government Life Insurance) accounts, the following guidelines and important points should be adhered to:

- Correct Policy Numbers: Always quote the correct policy numbers in the schedules submitted. This helps ensure that premium payments are accurately reflected in individual insurance accounts, thus avoiding discrepancies.

- Proposal Forms for Premium Increases: Whenever there is an increase in the TSGLI premium to obtain additional policies, a proposal form must be submitted. This is crucial for maintaining the integrity of the insurance coverage.

- Age Limit for Proposal Submission: It is important to submit the proposal form before reaching 56 years of age. This stipulation ensures that employees can benefit from the TSGLI scheme without any complications related to age restrictions.

- Policy Lapse: TSGLI policies do not lapse, providing continuous coverage as long as the premium payments are made on time. This offers peace of mind to policyholders regarding their life insurance protection.

- Low Premium Rates: The TSGLI scheme is designed with low premium rates, making it an affordable option for state government employees to secure their future.

- Tax Exemption: Premiums paid towards TSGLI are exempt from income tax under Section 80C, which is an added financial advantage for policyholders.

- Bonus Rates: The TSGLI scheme offers attractive bonus rates, enhancing the benefits for policyholders over time.

- Maximum Contribution: A state government employee can contribute a maximum premium of up to 20% of their basic pay, regardless of the applicable slab rates. This flexibility allows employees to choose a premium amount that suits their financial situation.

- Insurable Age Extension: The government enhanced the insurable age from 48 years to 53 years as per G.O.Ms.No.16 FINANCE (ADMIN.II) DEPARTMENT dated 17-02-2011. This change allows more employees to benefit from the TSGLI scheme.

- Extension to Municipal Employees: The Andhra Pradesh Government Life Insurance Scheme has been extended to municipal employees, including municipal teachers, with the exception of employees from GHMC, GVMC, and VMC as per G.O.Ms.No.25 FINANCE (ADMIN.II) DEPARTMENT dated 03-03-2011.

By adhering to these guidelines and understanding the key aspects of the TSGLI scheme, employees can effectively manage their policies and prevent any issues related to missing credits.

How to Download TGLI Missing Credits Annual Account Slip

To successfully download the TGLI (Telangana Government Life Insurance) Missing Credits Annual Account Slip, follow these simple steps:

- Go To Website: First of all, go to the TSGLI (Telangana State Government Life Insurance official website i.e., http://tgli.telangana.gov.in/. And click on the link "Annual Account Slip" given in the home page.

- Enter Correct Policy Number: Ensure that you input the correct policy number associated with your TSGLI account. Double-check for any typos or errors to avoid issues during the download process.

- Select the Year: Choose the relevant year for which you want to download the annual account slip. This is crucial as it determines the specific data you will receive.

- Click the "View Report" Button: Once you have entered the correct policy number and selected the year, click on the "View Report" button. This action will generate your annual account slip based on the provided information.

Following these steps will enable you to access your TGLI Missing Credits Annual Account Slip efficiently. Make sure to keep your policy number handy and verify the details before proceeding to avoid any complications.

How to Download TGLI Missing Credits Application Forms

TGLI Missing Credits Form PDF Download - To download the TGLI Missing Credits Application Forms, follow these simple steps:

- Go To Website: First of all, go to the TSGLI (Telangana State Government Life Insurance official website i.e., http://tgli.telangana.gov.in/. And click on the link "Application Forms" given in the home page.

- Click on the Desired Link: Locate the link for the application form on the official TSGLI website or the relevant portal. Click on the link to initiate the download.

- Save the File: Once the download prompt appears, choose the option to "Save" the file to your preferred location on your device. Ensure you remember where you saved it for easy access later.

- File Format: The downloaded file will be in PDF format, which is standard for official documents and forms.

- View the File: To view the extracted files, use a PDF reader such as Adobe Reader. If you don’t have it installed, you can download it for free from the official Adobe website.

- Download Speed: Please note that the time taken to download the file may vary based on the speed of your internet connectivity. Be patient if it takes a little longer than expected.

By following these steps, you can easily download the TGLI Missing Credits Application Forms and proceed with your application process.

How to Check TGLI Missing Credits Status Online

To check the status of your TGLI Missing Credits online, follow these straightforward steps:

- Go To Website: First of all, go to the TSGLI (Telangana State Government Life Insurance official website i.e., http://tgli.telangana.gov.in/. And click on the link "Status" given in the home page.

- Enter Policy Number: Start by entering your policy number in the designated field. For example, you can input a policy number like 123456.

- Select the Type of Inquiry: Choose the appropriate option from the dropdown menu, such as Loan, Claim, or Issue of Policy, depending on what you want to check.

- Enter Financial Year: Specify the financial year relevant to your inquiry. For instance, you could enter 2019-2020 if that is the year you need to check.

- Enter the Generated Number: After filling in the previous fields, a generated number will appear on the screen. Enter this number in the provided field to proceed.

- Click on "View": Finally, click the View button to retrieve your TGLI Missing Credits status.

By following these steps, you can easily access the current status of your TGLI Missing Credits and address any discrepancies promptly.

How to Download TGLI Missing Credits RTI Report

To download the TGLI Missing Credits RTI Report, follow these simple steps:

- Go To Website: First of all, go to the TSGLI (Telangana State Government Life Insurance official website i.e., http://tgli.telangana.gov.in/. And click on the link "RTI Report" given in the home page.

- Click on the Desired Link: Navigate to the website or portal where the RTI report is available. Click on the specific link provided for downloading the TGLI Missing Credits RTI Report.

- Save the File: After clicking the link, a prompt will appear asking you to save the file. Choose the appropriate location on your device and click “Save” to download the report.

- File Format: The downloaded file will be in PDF format, ensuring easy accessibility and compatibility across various devices.

- View the Extracted Files: Once the download is complete, you can open the file using Adobe Reader or any other compatible PDF viewer to access the report.

- Download Speed: Please note that the time taken to download the report may vary based on the speed of your internet connectivity.

By following these steps, you can easily access the TGLI Missing Credits RTI Report for your records or further inquiries.

Tsgli missing credits proforma pdf download

To download the TGLI Missing Credits Proforma PDF, follow these steps:

- Visit the Official TGLI Website: Navigate to the Telangana Government Life Insurance official website where the proforma is usually made available.

- Locate the Downloads Section: Look for a section related to forms or downloads, often found in the main menu or sidebar.

- Find the TGLI Missing Credits Proforma: In the downloads or forms section, search for the "TGLI Missing Credits Proforma." It may be listed among other forms related to TGLI services.

- Click on the Download Link: Once you find the correct form, click on the provided link to download the PDF file.

- Save the File: After clicking the link, the PDF should open in your browser. You can then save it to your device by clicking on the download icon or selecting "File" > "Save As."

If you have trouble finding the form on the website, it may also be helpful to contact the TGLI Department directly or check any announcements or circulars regarding missing credits on their platform.

Tips for Filling Out the TGLI Missing Credits Proforma

- Double-Check Information: Verify all details before submitting the form to avoid delays in processing.

- Attach Supporting Documents: Include any relevant documents that can substantiate your claim of missing credits.

- Timely Submission: Ensure the form is submitted as soon as possible to avoid further discrepancies.

Why is the TGLI Missing Credits Proforma Important?

The TGLI Missing Credits Proforma plays a pivotal role in ensuring the accuracy and integrity of your insurance records. Submitting this form promptly is crucial for several reasons:

- Maintaining Accurate Records: Filling out the TGLI Missing Credits Proforma allows you to report any discrepancies in your premium payments or missing credits. This ensures that your insurance records are accurate, reflecting all transactions appropriately.

- Maximizing Maturity Value: Addressing missing credits is essential to realizing the full maturity value of your policy. If credits are not recorded correctly, it can impact the total benefits you receive upon maturity, which could be detrimental to your financial planning.

- Financial Security: As a TGLI policyholder, ensuring that all credits are accurately reflected in your account is vital for your financial security. Missing credits can hinder your policy’s performance and benefits, potentially affecting the financial safety net for you and your family.

- Timely Reporting: The importance of promptly reporting and resolving missing credits cannot be overstated. By following the steps outlined in the guide, you can ensure your TGLI account is up-to-date and that you receive the total maturity value of your policy.

- Safeguarding Your Future: Accurate and timely reporting through the TGLI Missing Credits Proforma is crucial for safeguarding your financial future under the TGLI scheme. This proactive approach helps in avoiding complications and ensures that you benefit fully from your insurance policy.

In conclusion, the TGLI Missing Credits Proforma is more than just a form; it is a vital tool for protecting your financial interests and ensuring the reliability of your life insurance coverage.

What is the TGLI Missing Credits Proforma?

The TGLI Missing Credits Proforma is a crucial document designed for policyholders of the Telangana Government Life Insurance (TGLI) scheme to report any discrepancies related to missing credits in their accounts. This form serves as a formal request to the TGLI Department to rectify errors that may have occurred in the posting of premium payments or other contributions made by the policyholder.

By accurately filling out the TGLI Missing Credits Proforma, you provide essential information regarding the specific missing credits, such as the policy number, premium amounts, and relevant dates. This allows the TGLI Department to efficiently address any issues and ensure that your contributions are correctly recorded in your policy account.

Completing this form is vital for maintaining the integrity of your insurance records, as it helps to ensure that all premium payments are properly accounted for. Addressing these discrepancies promptly can prevent potential losses in policy benefits and ensure that you receive the full maturity value of your insurance coverage.

TGLI Missing Credits Important Links

| Policy Bond Link | http://tgli.telangana.gov.in/Tsgli_bond.aspx |

| Policy Search Link | http://tgli.telangana.gov.in/PolicyFinder.aspx |

| Policy Details Link | http://tgli.telangana.gov.in/PolicyDetails.aspx |

| Annual Account Slip Link | http://tgli.telangana.gov.in/AnnualReport.aspx |

| Application Forms Link | http://tgli.telangana.gov.in/Downloads.aspx |

| ONLINE Application Link | http://tgli.telangana.gov.in/Index.aspx |

| Status Link | http://tgli.telangana.gov.in/StatusofApplicant.aspx |

| RTI Report Link | http://tgli.telangana.gov.in/Rtiact2005.aspx |

| TGLI Missing Credits Login Link | http://tgli.telangana.gov.in |

Telegram

Telegram

Comments Shared by People