Pradhan Mantri Mudra Yojana Application Form PDF Download In Hindi & English

Pradhan Mantri Mudra Yojana Application Form PDF: Pradhan Mantri Mudra Yojana (PMMY) was launched on April 8, 2015, by the Government of India to provide financial support to small and micro enterprises. The primary objective of this initiative is to promote entrepreneurship among individuals, especially those from lower-income backgrounds, by offering loans without the need for collateral. Under PMMY, loans are categorized into three types: Shishu (up to ₹50,000), Kishore (from ₹50,001 to ₹5 lakh), and Tarun (from ₹5,00,001 to ₹10 lakh), catering to the varying needs of businesses at different stages of growth.

The scheme aims to empower small businesses and enhance their contribution to the economy by facilitating access to credit. This is particularly crucial for sectors like agriculture, manufacturing, and services, which often struggle to secure funding. PMMY has made it easier for individuals to set up their ventures, thus contributing to job creation and economic growth. Various public and private sector banks, as well as non-banking financial companies (NBFCs), are involved in disbursing these loans. By simplifying the loan application process and reducing bureaucratic hurdles, the Pradhan Mantri Mudra Yojana has become a significant driver of entrepreneurship in India.

Table of Contents

☰ Menu- Pradhan Mantri Mudra Yojana loan limit doubled to ₹20 lakh

- How To Download Pradhan Mantri Mudra Yojana Application Form PDF?

- Pradhan Mantri Mudra Yojana Application Form PDF

- How To Download Pradhan Mantri Mudra Loan Yojana Application Form PDF In Hindi?

- How To Download Pradhan Mantri Mudra Loan Yojana Application Form PDF?

- How To Download Pm Mudra Yojana Shishu Loan Application Form PDF

- How To Download PM Mudra Yojana Kishore Loan Application Form PDF

- How to Download Pradhan Mantri Mudra Yojana Tarun Loan Application Form PDF?

- How To Fill Pradhan Mantri Mudra Yojana Application Form PDF

- Where to submit Pradhan Mantri Mudra Yojana Application Form?

- Pradhan Mantri Mudra Yojana Loan Online Apply Process

- Documents required for Pradhan Mantri Mudra Yojana Application Form

- For Shishu Loan

- For Kishore and Tarun Loan

- Eligibility required for Pradhan Mantri Mudra Yojana Application Form

- Summary of Pradhan Mantri Mudra Loan Yojana Application Form PDF Download

Pradhan Mantri Mudra Yojana loan limit doubled to ₹20 lakh

The Pradhan Mantri Mudra Yojana (PMMY) has seen a significant enhancement in its loan limit, now allowing borrowers to access loans of up to ₹20 lakh. This change aims to provide greater financial support to small and micro enterprises, encouraging more ambitious business initiatives. Previously, the maximum loan amount was capped at ₹10 lakh.

This doubling of the loan limit is expected to empower entrepreneurs by facilitating larger investments in their businesses, thereby promoting economic growth and job creation. The initiative continues to foster entrepreneurship, particularly among individuals from lower-income backgrounds, enhancing their financial independence and business potential.

Ayushman Card Yojana List 2024

How To Download Pradhan Mantri Mudra Yojana Application Form PDF?

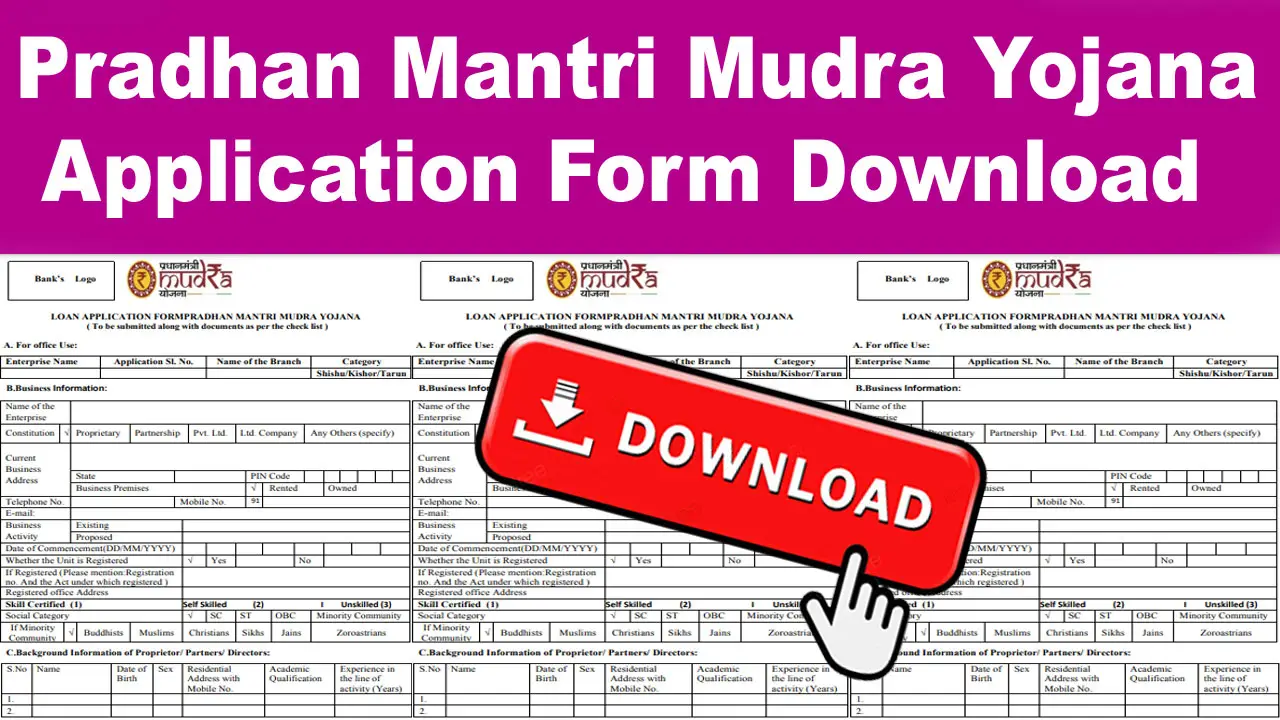

Pradhan Mantri Mudra Yojana Application Form PDF

The Pradhan Mantri Mudra Yojana (PMMY) application form is essential for individuals seeking financial assistance to start or expand their small and micro enterprises. The application process is designed to be straightforward, enabling applicants to provide necessary details easily. The form requires personal information, business details, and financial requirements, allowing banks and financial institutions to assess eligibility effectively.

To download the PMMY application form in PDF format, individuals can visit the official website of the Mudra Yojana or the respective bank's website participating in the scheme. Once downloaded, applicants should fill out the form accurately and submit it along with required documents, such as identity proof, address proof, and business plan. By simplifying access to credit, the PMMY empowers aspiring entrepreneurs to turn their business ideas into reality and contributes to the overall economic development of the country.

How To Download Pradhan Mantri Mudra Loan Yojana Application Form PDF In Hindi?

| Key Points | Details |

|---|---|

| Purpose | To provide financial support to small and micro enterprises. |

| Loan Categories | Shishu (up to ₹50,000), Kishore (₹50,001 to ₹5 lakh), Tarun (₹5,00,001 to ₹20 lakh). |

| Eligibility | Any Indian citizen planning to start or expand a small business. |

| Documents Required | Identity proof, address proof, business plan, and income details. |

| How to Download | Visit the official Mudra Yojana website or the website of participating banks. |

| Application Submission | Submit the filled application form along with required documents at the bank branch. |

| Loan Processing Time | Typically ranges from a few days to a few weeks, depending on the bank’s procedures. |

| Support | For assistance, applicants can contact the bank’s customer service or visit local branches. |

How To Download Pradhan Mantri Mudra Loan Yojana Application Form PDF?

To download the Pradhan Mantri Mudra Yojana application form PDF from the official website, follow these steps:

- Visit the Official Website: Open your web browser and go to https://www.mudra.org.in/.

- Navigate to the 'Downloads' Section: Look for a menu option labeled “Downloads” or “Application Forms.” This is typically found in the main navigation bar or under relevant sections of the site.

- Select the Application Form: In the downloads section, you will find various forms related to the Mudra Yojana. Locate the “Pradhan Mantri Mudra Yojana Application Form” link.

- Download the PDF: Click on the link for the application form. This should prompt the PDF file to download to your device.

- Print and Fill the Form: Once downloaded, open the PDF file, print it out, and fill in the required details.

- Submit the Form: After completing the form, submit it along with the required documents to the nearest bank branch participating in the Mudra Yojana.

By following these steps, you can easily download the application form for the Pradhan Mantri Mudra Yojana.

प्रधानमंत्री जीवन ज्योति बीमा योजना (पीएमजेजेबीवाई): क्लेम कैसे करें

How To Download Pm Mudra Yojana Shishu Loan Application Form PDF

To download the PM Mudra Loan Yojana Shishu Loan Application Form PDF, follow these steps:

- Visit the Official Website: Go to the official Mudra Yojana website at https://www.mudra.org.in/.

- Find the 'Downloads' Section: Look for a menu option labeled “Downloads,” “Application Forms,” or something similar on the homepage.

- Locate the Shishu Loan Application Form: In the downloads section, search for the application form specifically for the Shishu loan under the Pradhan Mantri Mudra Yojana.

- Download the Form: Click on the link for the Shishu Loan Application Form. This will initiate the download of the PDF file to your device.

- Open and Fill the Form: Once the download is complete, open the PDF file, print it, and fill in the necessary details.

- Submit the Form: After completing the application, submit it along with the required documents to your nearest bank branch that participates in the Mudra Yojana.

By following these steps, you can easily download the Shishu Loan Application Form for the PM Mudra Yojana.

How To Download PM Mudra Yojana Kishore Loan Application Form PDF

To download the PM Mudra Loan Yojana Kishore Loan Application Form PDF, follow these steps:

- Visit the Official Website: Open your web browser and go to the official Mudra Yojana website at https://www.mudra.org.in/.

- Access the 'Downloads' Section: Look for a menu option labeled “Downloads,” “Application Forms,” or something similar on the homepage.

- Find the Kishore Loan Application Form: In the downloads section, locate the application form specifically for the Kishore loan under the Pradhan Mantri Mudra Yojana.

- Download the Form: Click on the link for the Kishore Loan Application Form. This action will prompt the PDF file to download to your device.

- Open and Fill the Form: After the download is complete, open the PDF file, print it out, and fill in the required details.

- Submit the Form: Once the application is filled out, submit it along with the necessary documents to your nearest bank branch that participates in the Mudra Yojana.

By following these steps, you can easily download the Kishore Loan Application Form for the PM Mudra Yojana.

How to Download Pradhan Mantri Mudra Yojana Tarun Loan Application Form PDF?

To download the Pradhan Mantri Mudra Yojana Tarun Loan Application Form PDF, follow these steps:

- Visit the Official Website: Open your web browser and go to the official Mudra Yojana website at https://www.mudra.org.in/.

- Navigate to the 'Downloads' Section: Look for a menu option labeled “Downloads,” “Application Forms,” or a similar section on the homepage.

- Locate the Tarun Loan Application Form: In the downloads section, find the application form specifically for the Tarun loan under the Pradhan Mantri Mudra Yojana.

- Download the Form: Click on the link for the Tarun Loan Application Form. This should initiate the download of the PDF file to your device.

- Open and Fill the Form: Once the download is complete, open the PDF file, print it, and fill in the required details.

- Submit the Form: After completing the application form, submit it along with the necessary documents to the nearest bank branch that participates in the Mudra Yojana.

By following these steps, you can easily download the Tarun Loan Application Form for the PM Mudra Yojana.

प्रधानमंत्री सौभाग्य योजना ऑनलाइन आवेदन व लिस्ट

How To Fill Pradhan Mantri Mudra Yojana Application Form PDF

Here’s a short guide on how to fill the Pradhan Mantri Mudra Yojana application form PDF:

- Personal Information: Enter your name, date of birth, and contact details, including phone number and email address.

- Address Details: Fill in your permanent and current address with relevant proof.

- Business Information:

- Business Name: Write the name of your business.

- Type of Business: Specify whether it’s a sole proprietorship, partnership, etc.

- Business Address: Provide the location of the business.

- Loan Details: Indicate the amount you wish to borrow (Shishu, Kishore, or Tarun) and the purpose of the loan.

- Financial Information: Include details about your income, investments, and existing loans, if any.

- Documents: Attach required documents such as identity proof, address proof, and business plan.

- Signature: Sign the application form at the designated space.

- Submission: Submit the completed form and documents to the nearest bank branch.

Ensure all information is accurate to avoid delays in processing your application.

Where to submit Pradhan Mantri Mudra Yojana Application Form?

You can submit the Pradhan Mantri Mudra Yojana application form at the following places:

- Participating Banks: Submit the completed application form at any bank branch that participates in the Mudra Yojana. This includes public sector banks, private sector banks, and regional rural banks.

- Non-Banking Financial Companies (NBFCs): Some NBFCs also offer Mudra loans. You can submit your application at their branches.

- Micro Finance Institutions (MFIs): Certain MFIs are authorized to provide Mudra loans. You can visit them to submit your application.

- Online Submission: If the bank offers an online application process, you can submit the application through their official website.

- Government Offices: In some regions, you may also find designated government offices or centers where you can submit your application.

Ensure that you have all the required documents attached with your application for smooth processing.

Pradhan Mantri Mudra Yojana Loan Online Apply Process

Here’s a short guide on the online application process for the Pradhan Mantri Mudra Yojana (PMMY):

- Visit the Official Website: Go to the official Mudra Yojana website or the website of a participating bank.

- Find the Application Section: Look for the "Apply Online" or "Mudra Loan Application" link.

- Select Loan Type: Choose the type of loan you wish to apply for: Shishu, Kishore, or Tarun.

- Fill Out the Application Form: Provide your personal, business, and financial details in the online application form.

- Upload Documents: Attach required documents such as identity proof, address proof, and a business plan.

- Review and Submit: Check all entered information for accuracy and submit the application.

- Receive Acknowledgment: Note the acknowledgment number for tracking your application status.

By following these steps, you can easily apply for a loan under the Pradhan Mantri Mudra Yojana online.

Documents required for Pradhan Mantri Mudra Yojana Application Form

Here’s a summarized list of documents required for the Pradhan Mantri Mudra Yojana application form, divided by loan type:

For Shishu Loan

- Proof of Identity: Self-attested copy of Voter ID, Driving License, PAN Card, Aadhaar Card, Passport, or other government-issued photo IDs.

- Proof of Residence: Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter ID, Aadhaar Card, Passport, or bank passbook with a latest account statement. Domicile Certificate or certificate from a government authority/local Panchayat/Municipality.

- Photographs: Two recent colored photographs (not older than 6 months).

- Quotation of Machinery/Items: Details of machinery or items to be purchased, including supplier name and price.

- Business Proof: Copies of relevant licenses, registration certificates, or other documents verifying the ownership and address of the business unit.

For Kishore and Tarun Loan

- Proof of Identity: Self-attested copy of Voter ID, Driving License, PAN Card, Aadhaar Card, or Passport.

- Proof of Residence: Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter ID, Aadhaar Card, or Passport of Proprietor/Partners/Directors.

- Photographs: Two recent colored photographs (not older than 6 months).

- Business Proof: Copies of relevant licenses, registration certificates, or other documents verifying the ownership and address of the business unit.

- Bank Details: Statement of accounts for the last six months from the existing banker (if any).

- Financial Statements: Last two years' balance sheets along with income tax/sales tax returns (applicable for loans from ₹2 lakhs and above). Projected balance sheets for one year for working capital limits and the duration of the loan for term loans.

- Sales Information: Sales achieved during the current financial year up to the date of application.

- Project Report: Details of the proposed project containing technical and economic feasibility.

- Company Documents: Memorandum and Articles of Association (for companies) or Partnership Deed (for partnerships).

- Net Worth Statement: Asset and Liability statement from the borrower, including Directors and Partners, if a third-party guarantee is absent.

Make sure to gather all required documents before submitting your application to ensure a smooth process.

Eligibility required for Pradhan Mantri Mudra Yojana Application Form

Here’s a summary of the eligibility requirements for the Pradhan Mantri Mudra Yojana (PMMY) application:

Eligible Borrowers

- Individuals: Any individual with a viable business plan.

- Proprietary Concern: Single-owner businesses.

- Partnership Firms: Multiple owners in a registered partnership.

- Private Ltd. Company: Privately held companies with limited liability.

- Public Company: Companies that are publicly traded.

- Other Legal Forms: Any legally recognized business entity.

Key Eligibility Notes

- No Default Status: The applicant must not be a defaulter with any bank or financial institution and should have a good credit history.

- Skills/Experience: Individual applicants should have the necessary skills, experience, or knowledge for the proposed business activity.

- Educational Qualification: Any educational requirement depends on the nature of the proposed business activity and its specific demands.

These requirements ensure that borrowers under PMMY are prepared and capable of successfully running their proposed ventures.

Summary of Pradhan Mantri Mudra Loan Yojana Application Form PDF Download

The Pradhan Mantri Mudra Yojana (PMMY) Application Form PDF is available for individuals and businesses seeking financial support for small enterprises. To download the form, visit the official Mudra website or a participating bank’s website, where forms are categorized by loan types: Shishu (up to ₹50,000), Kishore (₹50,000–₹5 lakh), and Tarun (₹5 lakh–₹10 lakh). Applicants need to fill out details such as personal information, business details, and financial requirements. Required documents include proof of identity, address, and business ownership. Submit the completed form along with documents at any participating bank or financial institution.

What is the Pradhan Mantri Mudra Yojana?

PMMY is a government scheme that offers loans up to ₹10 lakh to small businesses and entrepreneurs under three categories: Shishu, Kishore, and Tarun.

Where can I download the Mudra loan application form PDF?

You can download it from the official Mudra website (mudra.org.in) or from participating banks’ websites.

What documents are required to apply?

Required documents include proof of identity, address, business ownership, financial statements (for Kishore and Tarun), and bank statements.

What is the loan amount for each category?

Shishu loans offer up to ₹50,000, Kishore loans offer between ₹50,000 and ₹5 lakh, and Tarun loans cover ₹5 lakh to ₹10 lakh.

Are there any processing fees?

Shishu loans generally have no processing fees, while Kishore and Tarun may have fees as per the bank's guidelines.

Can individuals apply for the Mudra loan?

Yes, individuals, proprietary concerns, partnerships, and companies are eligible.

Is collateral required for the Mudra loan?

No, Mudra loans do not require collateral.

What is the interest rate on Mudra loans?

Interest rates vary by bank and loan type; it is generally lower due to government backing.

How do I submit the completed application form?

Submit it at any participating bank or financial institution, along with the necessary documents.

What is the loan repayment period?

Loan terms vary based on the lender and loan amount but typically range from 3 to 5 years.

Telegram

Telegram

Comments Shared by People