Ponmagan Podhuvaippu Nidhi Scheme (PPNS) 2024: Interest Rate Calculator

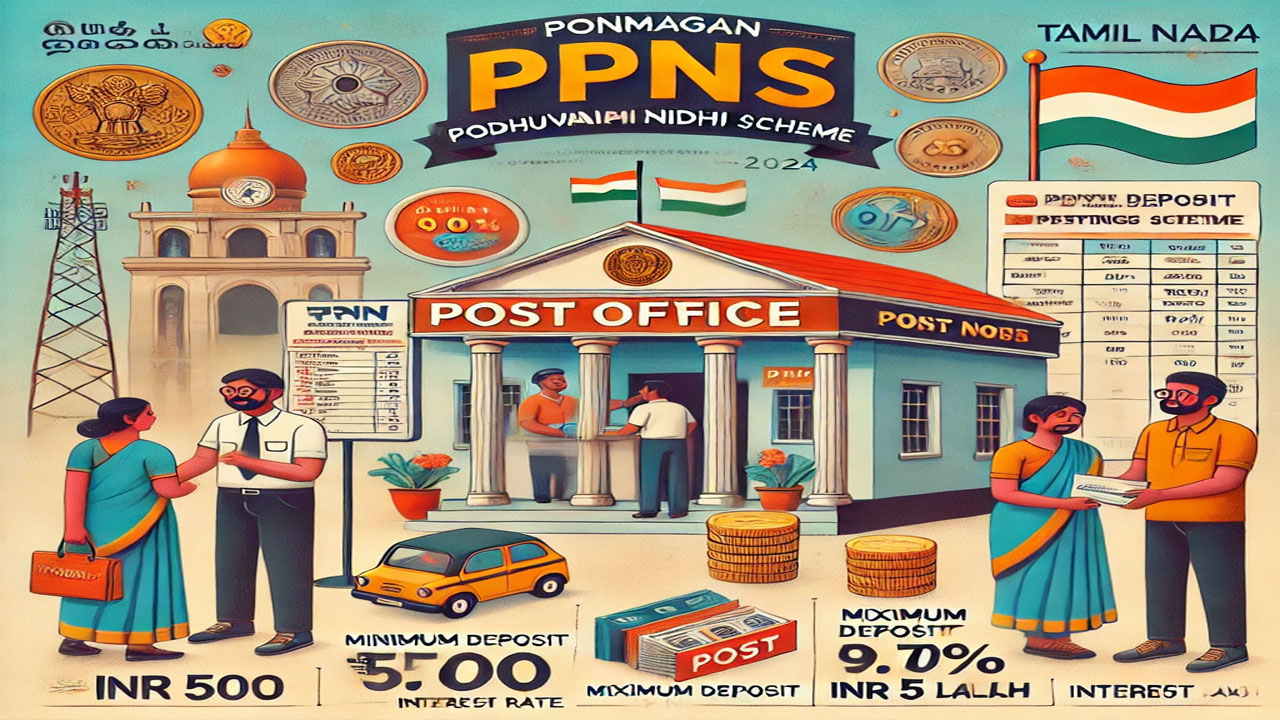

The Tamil Nadu state government has introduced the Ponmagan Podhuvaippu Nidhi Scheme (PPNS) 2024 to provide financial support to male residents of Tamil Nadu. Through this initiative, eligible male citizens of the state can open a savings account in the post office. By opening an interest-bearing account, participants are encouraged to develop a savings habit for future financial security. The PPNS scheme offers an interest rate that is higher compared to regular savings accounts in most banks across India. This scheme aims to promote financial stability and encourage long-term savings among the state's youth.

Table of Contents

☰ Menu- What is Ponmagan Podhuvaippu Nidhi Scheme?

- Helpful Summary of Ponmagan Podhuvaippu Nidhi Scheme

- Eligibility Criteria

- Benefits of The Scheme

- Interest Rate

- Required Documents

- Contribution Amount

- Maturity Period

- Tax Benefits Under Scheme

- Ponmagan Podhuvaippu Nidhi Scheme Application Process 2024

- Ponmagan Podhuvaippu Nidhi Scheme Interest Rate Calculator

- Simple Interest Formula:

- Example Calculation:

- Summary of Ponmagan Podhuvaippu Nidhi Scheme 2025

What is Ponmagan Podhuvaippu Nidhi Scheme?

The Ponmagan Podhuvaippu Nidhi Scheme was introduced by the Tamil Nadu state government with the primary objective of fostering a culture of savings among male citizens. This initiative allows all residents of Tamil Nadu, aged 10 years and above, to open an account under the scheme. For those under the age of 10, parents can open an account on their behalf. The scheme requires a minimum deposit of INR 500, with a maximum deposit limit of INR 5 lakh. The interest rate offered on deposits is 9.70%. This scheme is available to all permanent residents of Tamil Nadu, enabling them to enjoy the benefits of this financial program.

Tamil Nadu Special Small Business Loan Scheme

Helpful Summary of Ponmagan Podhuvaippu Nidhi Scheme

| Scheme Name | Ponmagan Podhuvaippu Nidhi Scheme |

|---|---|

| Launched by | Tamil Nadu state government |

| Objective | Provide saving account |

| Beneficiaries | Tamil Nadu state citizens |

| Official Website | [Comming Soon] |

Eligibility Criteria

- The applicant must be a permanent resident of Tamil Nadu.

- The applicant must be a male citizen of Tamil Nadu.

- The applicant must belong to the Economically Weaker Section (EWS).

- The child should not be receiving any other financial assistance for education from the government.

- The applicant will only receive the money after five years have passed.

- The account can only be transferred once in the name of any individual.

Benefits of The Scheme

- Savings Account in Post Office: Selected applicants can open a savings bank account at the post office.

- Encourages Saving: The scheme aims to encourage the citizens of Tamil Nadu to develop a habit of saving.

- Low Initial Deposit: Applicants can start with a minimum deposit of INR 500.

- High Interest Rate: The scheme offers an annual interest rate of 9.70%.

- Competitive Interest Rate: The interest rate is higher compared to most savings accounts in banks across India.

Interest Rate

The interest rate under the Ponmagan Podhuvaippu Nidhi Scheme (PPNS) 2024 is 9.70% annually.

Tamil Nadu Kalaignar Kaivinai Thittam 2025

Required Documents

- Identity Proof

- Address Proof

- Education Certificates

- Bank Account Details

- Income Proof.

Contribution Amount

- Minimum Amount to Open the Account: INR 100

- Minimum Annual Deposits: INR 500

- Maximum Annual Amount: INR 5 lakh

Maturity Period

The maturity period of the Ponmagan Podhuvaippu Nidhi Scheme (PPNS) 2024 is 15 years.

Tax Benefits Under Scheme

The applications did not have to pay any Tax under the PPNS 2024.

Ponmagan Podhuvaippu Nidhi Scheme Application Process 2024

- Applicants from Tamil Nadu who wish to apply for the scheme should first visit the nearest post office branch in the state.

- Upon reaching the post office, the applicant must request the application form from the concerned official.

- The applicant should then fill out the application form and attach all the necessary documents.

- After completing the application form, the applicant should carefully review the information and submit it to the concerned official.

- Once the verification process is completed, the applicant will be enrolled as a beneficiary under the Ponmagan Podhuvaippu Nidhi Scheme.

Ponmagan Podhuvaippu Nidhi Scheme Interest Rate Calculator

To calculate the interest earned under the Ponmagan Podhuvaippu Nidhi Scheme, we can use the formula for simple interest since this scheme offers an annual interest rate.

Simple Interest Formula:

Where:

- P = Principal amount (the amount deposited)

- R = Annual interest rate (9.70% for this scheme)

- T = Time period in years

Example Calculation:

If a person deposits INR 10,000 for 1 year, the interest calculation would be:

So, the interest earned on a deposit of INR 10,000 for one year would be INR 970.

Let me know if you'd like me to calculate for a specific deposit amount and time period!

Summary of Ponmagan Podhuvaippu Nidhi Scheme 2025

The Ponmagan Podhuvaippu Nidhi Scheme (PPNS) 2024, launched by the Tamil Nadu government, encourages male citizens to open savings accounts in post offices with a 9.70% interest rate. Aimed at fostering a savings culture, the scheme offers a low initial deposit of INR 500 and a maturity period of 15 years, benefiting economically weaker sections of society.

What is the Ponmagan Podhuvaippu Nidhi Scheme?

The Ponmagan Podhuvaippu Nidhi Scheme is a financial initiative launched by the Tamil Nadu government to promote savings among male citizens. It allows eligible individuals to open a savings account in post offices, offering an interest rate of 9.70%.

Who is eligible to apply for the scheme?

Male permanent residents of Tamil Nadu, particularly from the Economically Weaker Section (EWS), are eligible to apply. Additionally, individuals aged 10 years and above can open an account, and those under 10 years can have their accounts opened by parents.

What is the minimum and maximum deposit limit for the scheme?

The scheme requires a minimum deposit of INR 500, with a maximum deposit limit of INR 5 lakh.

What interest rate does the Ponmagan Podhuvaippu Nidhi Scheme offer?

The scheme offers an annual interest rate of 9.70%, which is higher than typical savings accounts in most banks across India.

What is the maturity period of the scheme?

The maturity period for the Ponmagan Podhuvaippu Nidhi Scheme is 15 years.

Is there any tax benefit under the scheme?

There are no taxes levied on the benefits accrued under this scheme, making it a tax-efficient savings option.

Can the account be transferred?

Yes, the account can only be transferred once in the name of any individual, ensuring ownership continuity.

What documents are required to apply for the scheme?

Applicants need to submit identity proof, address proof, education certificates, income proof, and bank account details.

How can one apply for the Ponmagan Podhuvaippu Nidhi Scheme?

Applicants can visit any post office in Tamil Nadu, request the application form, fill it out, and submit the necessary documents for verification.

What is the minimum amount required to open an account?

The minimum amount to open an account under the Ponmagan Podhuvaippu Nidhi Scheme is INR 100, and the minimum annual deposit is INR 500.

Telegram

Telegram

Comments Shared by People