NPS Vatsalya Yojana Apply Online - NPS Vatsalya Yojana Tax Benefits & How to Apply Online

NPS Vatsalya Yojana Apply Online, NPS Vatsalya Scheme, eNPS - NSDL, Nirmala Sitharaman Launch NPS Vatsalya Scheme, Apply Online for Nps Vatsalya Scheme, Nps vatsalya yojana apply online login, NPS login, NPS Vatsalya Scheme In Hindi, NPS Vatsalya Calculator, NPS Vatsalya Login, NPS Vatsalya Scheme PDF, How to open NPS Vatsalya account, NPS calculator,

.webp)

The National Pension Scheme (NPS) has been a cornerstone of retirement planning in India, offering a structured savings plan for individuals. To extend this benefit to the younger generation, Finance Minister Nirmala Sitharaman has launched the "NPS Vatsalya Yojana," a unique variant of the existing NPS, tailored specifically for minors. This blog explores the NPS Vatsalya Yojana, its features, benefits, eligibility, and the process to apply online.

Table of Contents

☰ Menu- key points of the NPS Vatsalya Yojana

- What is the NPS Vatsalya Yojana?

- Eligibility for NPS Vatsalya Yojana

- Applicability of NPS Vatsalya Yojana

- How to Apply for NPS Vatsalya Yojana Online?

- Documents Required for NPS Vatsalya Yojana

- Investment Choices under NPS Vatsalya Yojana

- Withdrawal and Exit Rules

- Benefits of NPS Vatsalya Yojana

- Related Link

- NPS Vatsalya Yojana in Case of Unfortunate Events

- Importent Link

- Summary

- FAQs on NPS Vatsalya Yojana Apply Online

key points of the NPS Vatsalya Yojana

| Aspect | Details |

|---|---|

| Scheme Name | NPS Vatsalya Yojana |

| Introduced By | Finance Minister Nirmala Sitharaman |

| Launch Year | Budget 2024 |

| Target Beneficiaries | Minors (below 18 years) |

| Eligibility | - Indian citizens below 18 years- NRI and OCI individuals below 18 years- Parents or guardians of a minor child can open the account on behalf of the minor |

| Minimum Contribution | Rs. 1,000 per year |

| Maximum Contribution | No upper limit |

| Conversion to Standard NPS | Automatically converted to a regular NPS account when the child turns 18 |

| Investment Choices | - Default Choice: Moderate Lifecycle Fund - LC-50 (50% equity)- Auto Choice: Aggressive, Moderate, or Conservative Lifecycle Funds- Active Choice: Flexible allocation across equity, government securities, corporate debt, and alternate assets |

| Withdrawal Rules | - Partial withdrawal allowed after 3 years- Maximum 25% of the contributed amount- Withdrawal permitted 3 times before the child turns 18 for specific reasons |

| Exit Conditions | - Convert to standard NPS account at 18- Withdraw 80% as annuity and 20% as lump sum- Full withdrawal if corpus is less than Rs. 2.5 lakh |

| Benefits | - Encourages early savings habits- Provides financial security for the child's future- Promotes responsible financial management- Offers flexibility and portability of the NPS account |

| Documents Required | - Aadhaar card of the guardian- Date of birth proof of the minor- Guardian's signature- For NRI/OCI: Passport, foreign address proof, bank proof |

| Application Process | - Online via eNPS website- Through Points of Presence (POPs) like India Post, banks, Pension Funds |

What is the NPS Vatsalya Yojana?

The NPS Vatsalya Yojana, introduced in the Budget 2024, is a novel pension scheme designed for minors. It allows parents and guardians to open an NPS account in their child’s name and make regular contributions until the child reaches the age of 18. The scheme aims to foster a habit of early savings and create a substantial retirement corpus for the child. It offers the following key features:

- Parents or guardians can contribute monthly or yearly, with a minimum contribution of Rs. 1,000 per year.

- There is no upper limit on the contribution amount.

- The scheme can be converted into a regular NPS account when the child turns 18.

Eligibility for NPS Vatsalya Yojana

To participate in the NPS Vatsalya Yojana, the following eligibility criteria must be met:

- Age: The scheme is available for Indian citizens below 18 years, including Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs).

- Guardianship: Parents or legal guardians can open the account on behalf of the minor.

Applicability of NPS Vatsalya Yojana

The NPS Vatsalya Yojana is applicable to all minor children in India. Once the child reaches 18 years, the scheme automatically converts into a standard NPS account. This transition allows the child to take charge of their pension planning independently, ensuring lifelong financial security.

How to Apply for NPS Vatsalya Yojana Online?

Applying for the NPS Vatsalya Yojana online is a straightforward process. Here’s a step-by-step guide:

- Visit the eNPS Website: Begin by visiting the official eNPS website.

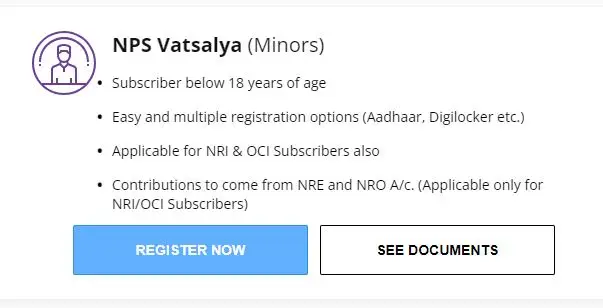

- Select 'Register Now': Navigate to the 'NPS Vatsalya (Minors)' tab and click on ‘Register Now.’

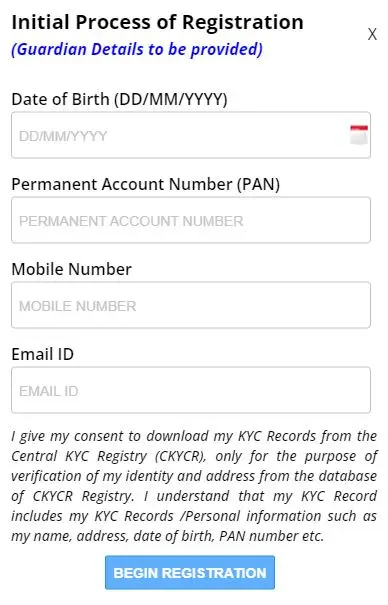

- Enter Guardian's Details: Input the guardian's date of birth, PAN number, mobile number, and email address. Click ‘Begin Registration.’

- Enter Guardian's Details: Input the guardian's date of birth, PAN number, mobile number, and email address. Click ‘Begin Registration.’

- OTP Verification: Verify the guardian’s identity by entering the OTP received on the registered mobile number and email.

- Enter Minor's Details: After OTP verification, provide the minor's personal details, along with the guardian's information.

- Upload Required Documents: Upload the necessary documents, including the Aadhaar card of the guardian and the minor's date of birth proof.

- Initial Contribution: Make an initial contribution of Rs. 1,000 to activate the account.

- PRAN Generation: Post successful registration, the Permanent Retirement Account Number (PRAN) is generated, marking the account's creation.

Documents Required for NPS Vatsalya Yojana

To open an NPS Vatsalya account, the following documents are required:

- Guardian’s Aadhaar Card: For identity verification.

- Minor’s Date of Birth Proof: To establish eligibility.

- Guardian’s Signature: A scanned copy for submission.

- NRI/OCI Subscribers: Scanned copy of the passport, foreign address proof, and bank proof.

Investment Choices under NPS Vatsalya Yojana

NPS Vatsalya offers various investment options to suit different risk appetites:

- Default Choice: Moderate Lifecycle Fund - LC-50 (50% equity).

- Auto Choice: Options include Aggressive Lifecycle Fund - LC-75 (75% equity), Moderate Lifecycle Fund - LC-50 (50% equity), and Conservative Lifecycle Fund - LC-25 (25% equity).

- Active Choice: Allows parents to actively decide fund allocation across equity (up to 75%), government securities (up to 100%), corporate debt (up to 100%), and alternate assets (up to 5%).

Withdrawal and Exit Rules

The NPS Vatsalya scheme offers flexibility in withdrawal before the child turns 18:

- Partial Withdrawal: Allowed after three years of account opening. Parents or guardians can withdraw up to 25% of the contributed amount for specific purposes like education, disability (over 75%), or critical illness.

- Withdrawal Limits: The withdrawal option is limited to three times until the child attains the age of majority.

- Exit at 18: Upon turning 18, the NPS Vatsalya account can either be converted into a standard NPS account or exited. If exiting, at least 80% of the accumulated corpus must be reinvested into an annuity plan, while the remaining 20% can be withdrawn as a lump sum.

Benefits of NPS Vatsalya Yojana

NPS Vatsalya Yojana offers several benefits that make it an attractive option for parents seeking to secure their child’s future:

- Early Savings Habit: It inculcates a habit of early savings in children, preparing them for a financially secure future.

- Substantial Retirement Corpus: Starting contributions when the child is a minor helps accumulate a significant retirement corpus by the time they retire.

- Flexible Investment Choices: Offers a range of investment options, including equity, government securities, and corporate debt, catering to varying risk preferences.

- Financial Independence: Once converted into a standard NPS account, the child can independently manage their retirement planning.

- Portability: The NPS scheme allows flexibility in employment changes without affecting the pension account.

Related Link

NPS Vatsalya Yojana in Case of Unfortunate Events

The scheme also provides guidelines for managing the account in the event of unforeseen circumstances:

- Death of Minor: The entire corpus is returned to the guardian or nominee.

- Death of Guardian: Another guardian can be registered under the scheme after completing fresh KYC.

- Death of Both Parents: The legal guardian can continue the scheme without contributions until the child attains 18 years.

Importent Link

| Website | Official Website |

| Registration/ Login | login |

Summary

The NPS Vatsalya Yojana is a strategic financial tool for parents and guardians to ensure their child’s long-term financial stability. By initiating early savings, it guarantees a significant retirement corpus, teaching children the importance of financial planning from a young age. With its flexible investment options, tax benefits, and robust security measures, the NPS Vatsalya Yojana stands out as a premier scheme for securing the future of the younger generation.

FAQs on NPS Vatsalya Yojana Apply Online

Can NRIs open an NPS Vatsalya account?

Yes, NRIs and OCIs below 18 years can open an NPS Vatsalya account.

What is the minimum contribution required for NPS Vatsalya?

The minimum contribution required is Rs. 1,000 per year.

Can I withdraw from the NPS Vatsalya account before my child turns 18?

Yes, partial withdrawal is allowed after three years of joining, with specific conditions.

What happens to the NPS Vatsalya account when the child turns 18?

The account is converted into a standard NPS account, and the child can manage it independently.

What documents are required to open an NPS Vatsalya account?

Aadhaar card of the guardian, date of birth proof of the minor, guardian’s signature, and additional documents for NRI/OCI subscribers.

Telegram

Telegram

Comments Shared by People