IGRS Delhi: Property Registration, Stamp Duty @ DORIS Portal

Delhi property registration details, Igrs delhi online, Igrs delhi search by name, DORIS Delhi, Property Search by name in Delhi, Igrs delhi fees, Online property registration check Delhi, Igrs delhi address, Igrs delhi online search, Igrs delhi online search by name, Igrs delhi online registration, Online property registration check Delhi, Delhi property registration details, Property Search by name in Delhi, Igrs delhi online payment, Igrs delhi online appointment, IGRS Delhi 2025: Property Registration, Stamp Duty @ DORIS Portal

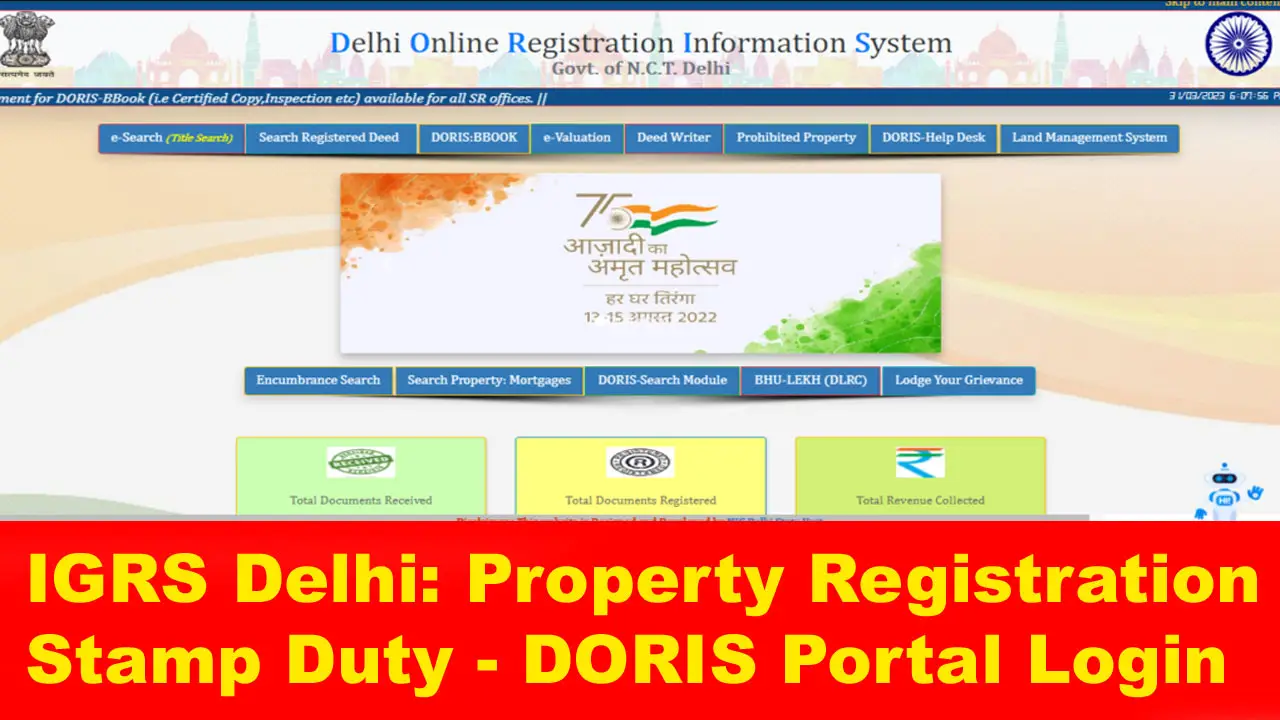

If you're looking to buy property in New Delhi and have concerns about property registration and documentation, the government has a solution through the IGRS Delhi. The Inspector-General of Registration and Stamps (IGRS) is the key department handling property registration services. Through an online portal, this government service streamlines the often time-consuming property registration process. The portal not only speeds up the registration process but also ensures transparency. It allows users to easily calculate registration fees and stamp duty, as well as check previous property details, plans, maps, and land records. The platform is officially known as the Delhi Online Registration Information System (DORIS).

Table of Contents

☰ Menu- IGRS Delhi Features

- Advantages of DORIS Online Portal for IGRS New Delhi

- How Can I Use the IGRS New Delhi Services?

- IGRS New Delhi Property Registration Procedures

- Documents to be Carried to Sub-Registrar’s Office

- IGRS New Delhi Stamp Duty Fees and Other Verifications

- Property Modification Under IGRS New Delhi

- Summary of IGRS Delhi Portal 2025

IGRS Delhi Features

The IGRS Delhi offers a wide range of services and provisions for purchasing and registering real estate, simplifying the often paperwork-heavy and time-consuming process. Through the DORIS Delhi portal, users can access most of these services online, making property registration much more efficient. Some of the key features include:

- Searching for Registered Documents: Users can easily find previously registered property documents.

- Inspecting Deed Documents: The portal allows for the inspection of deed documents to ensure transparency and clarity.

- Stamp Duty Calculation: The platform offers tools to calculate the stamp duty that needs to be paid for property transactions.

- Drafting Deed Documents: Users can generate and prepare deed documents online, streamlining the process.

- Sub-Registrar Services: The portal facilitates various sub-registrar services such as inspection, No Objection Certificates (NOCs), certified copies of documents, and more.

- Grievance and Complaint Redressal: There is a system in place for filing complaints and addressing grievances related to property registration.

- Dues Payable to Local Bodies: Users can view and settle any dues payable to local authorities, ensuring smooth property transactions.

- Listing of Prohibited Properties in Delhi: The portal also provides information on properties that are prohibited for sale or registration in Delhi, ensuring legal clarity for potential buyers.

Advantages of DORIS Online Portal for IGRS New Delhi

The IGRS New Delhi online portal, also known as DORIS, offers several advantages that make property registration and documentation much easier and more efficient. Here are some key benefits:

- Property Valuation: The portal provides a property valuation tool, allowing users to assess the value of their property in New Delhi. By simply entering the location details of the property, users can quickly get an estimate of its value.

- Real-Time Updates: The DORIS portal ensures that information is constantly updated in real time. Users can access the latest data on documents received, registered, and compiled, along with other important property-related details, accessible at any time from anywhere.

- Property Search: The portal offers an easy-to-use search feature that allows users to check the registration status of their property and obtain other relevant information. Additionally, documents for properties located in certain areas can be downloaded directly from the portal.

- Simple Navigation: The DORIS portal is designed with user-friendliness in mind. Even for first-time users, it is easy to navigate. Key sections of the portal are conveniently linked from the homepage, making it simple to find answers to queries by visiting the relevant area.

How Can I Use the IGRS New Delhi Services?

To access the online registration services, simply visit the official DORIS Delhi website. The homepage of the IGRS New Delhi portal offers a range of options to assist with various property registration processes. Here's how you can navigate the site:

- e-Search: Use this feature to search for registered documents, view property-related details, and check the status of your property.

- Restricted Property Lookup: Check for properties that are restricted or prohibited for sale or registration in Delhi.

- Registered Deeds Search: Find previously registered deed documents and inspect their details.

- Encumbrance Search: Verify whether there are any encumbrances or legal issues tied to a property.

The portal is designed to provide easy access to all these services, allowing users to handle property transactions and related queries conveniently online.

IGRS New Delhi Property Registration Procedures

To complete your property registration through IGRS New Delhi, follow these steps using the DORIS Delhi website:

- Start the Process: Visit the DORIS Delhi website and select the “Deed Writer” option from the top menu. A new page will open where you can create your deed according to your requirements. You'll need to choose the type of deed from a dropdown menu and provide details for the first party, second party, and witnesses.

- Calculate Stamp Duty: To calculate the payable stamp duty, click the e-Evaluation button on the website. A page will open where you can enter necessary details to determine the stamp duty amount. You'll need to select the sub-registrar, locality, deed type, and sub-deed from the provided options.

- Purchase e-Stamp Paper: Once the stamp duty value is calculated, purchase the necessary electronic stamp paper. You can buy this at the nearest Stock Holding Corporation of India (SHCIL) office or directly through their website (https://www.stockholding.com). To purchase online, select Products and Services, followed by e-Stamp Services and e-Registration.

- Create an Account and Make Payment: If you're using the system for the first time, register on the website to get a secure login ID and password. If you already have an account, simply log in with your credentials and verification code. Then, proceed to pay the registration fee. Once the payment is successful, download the receipt.

- Schedule an Appointment with the Sub-Registrar: The final step is to visit the sub-registrar’s office. You must book an appointment through the Revenue Department’s Appointment Management System at https://srams.delhi.gov.in. During booking, enter the property address, location (district), and the sub-registrar’s office address. Make sure the sub-registrar’s office is near the property’s location.

- Prepare Documents for Appointment: Ensure you have all required documents for your appointment. The system will ask if all documents are ready. If so, confirm by selecting Yes. Enter the e-stamp number from the downloaded receipt. After verification, you can confirm your appointment, and you’ll receive an SMS with the date, time, and location.

- Missed Appointments: If you miss your appointment, you can reschedule it once using the same procedure. Keep in mind that rescheduling is allowed only once.

This process makes property registration in New Delhi more efficient, reducing paperwork and ensuring transparency.

Documents to be Carried to Sub-Registrar’s Office

When attending your appointment with the sub-registrar, you must bring the following documents. This list is also available on the appointment scheduling system:

- Property Documents: Both the original and photocopies of all property-related documents.

- ID Proofs: Original ID proofs for the buyer, seller, and witnesses, including Aadhaar numbers.

- Photographs: Two passport-sized photographs of both the buyer and the seller.

- e-Stamp Paper: A hard copy of the e-stamp paper showing the stamp duty amount.

- e-Registration Fee Receipt: The receipt confirming the payment of the e-registration fee.

- Form 60/PAN Card: Form 60 or a copy of the PAN card, self-attested.

- NOC for Agricultural Land: If the property is located on agricultural land, a No Objection Certificate (NOC) must be provided.

Ensure all documents are ready before your appointment to avoid delays.

IGRS New Delhi Stamp Duty Fees and Other Verifications

- Stamp Duty Fees: The registration fee is typically 1% of the property’s total sale price. Stamp duty rates vary based on the buyer's gender:

- 4% for female buyers

- 6% for male buyers

- Other Important Verifications: Before finalizing your property registration, ensure that you carefully review all essential documents related to the property. These may include:

- Mother Deed: The primary document that proves the ownership lineage.

- Encumbrance Certificate: To check for any legal liabilities or disputes on the property.

- Property Tax Receipts: To verify the payment history of property taxes.

- Building Permit: To ensure the property complies with local building regulations.

You can verify these documents through the DORIS Delhi website and with the assistance of registering officials. It's crucial to have all the required documents in order to avoid delays or issues during registration.

Property Modification Under IGRS New Delhi

After successfully registering your property with IGRS New Delhi, it is important to proceed with property mutation. Mutation is the official process that records the change in ownership of a property, and it must be updated with local authorities. This ensures that the new owner’s details are reflected in the records, which is crucial for:

- Property Tax: Municipal authorities will use the updated ownership details to levy property tax on the new owner.

- Utility Connections: For legal water and electricity connections in the new owner's name, a mutation certificate is required.

To initiate the property mutation process, visit the official website of the Municipal Corporation of Delhi (MCD) at mcdonline.nic.in. The documents required for mutation depend on the type of property transfer:

- Form A: Used for non-inheritance property transfers.

- Form B: Used for property transfer through inheritance.

Make sure to complete the mutation process after property registration to ensure all ownership details are officially recognized by local authorities.

Summary of IGRS Delhi Portal 2025

The IGRS Delhi portal, also known as DORIS (Delhi Online Registration Information System), simplifies property registration and documentation. It offers services like deed document drafting, stamp duty calculation, property searches, and access to registered documents. The platform ensures transparency, real-time updates, and easy navigation for users. Key features include property valuation, e-registration, and grievance redressal, making property transactions more efficient and user-friendly in New Delhi.

What is IGRS Delhi?

IGRS Delhi is the Inspector-General of Registration and Stamps, which handles property registration services in Delhi through the online portal DORIS (Delhi Online Registration Information System).

How do I access IGRS Delhi services?

You can access IGRS Delhi services by visiting the official DORIS Delhi website.

What is the registration fee for property?

The registration fee is typically 1% of the property's sale price. Stamp duty varies: 4% for female buyers and 6% for male buyers.

Can I calculate stamp duty online?

Yes, the DORIS portal offers tools to calculate the stamp duty based on property details.

How do I schedule an appointment with the sub-registrar?

You can schedule an appointment online through the Revenue Department's Appointment Management System (SRAMS).

What documents are required for property registration?

Required documents include property papers, ID proofs, passport-sized photographs, e-stamp papers, e-registration fee receipts, and PAN or Form 60.

How can I check property registration status?

You can use the DORIS portal’s e-Search feature to check the registration status of a property.

What is property mutation?

Mutation is the process of updating ownership records with local authorities for property tax and utility connection purposes after registration.

How do I obtain a No Objection Certificate (NOC) for agricultural land?

If your property is agricultural, you will need an NOC from the concerned authority, which must be submitted during registration.

Can I reschedule my appointment if I miss it?

Yes, you can reschedule your appointment once using the same procedure, but only once.

Telegram

Telegram

Comments Shared by People