IGRS AP 2024: EC Search, Stamp & Registration, Market Value, Deed Details

IGRS AP CC download, IGRS AP CC download PDF, IGRS AP deed details, IGRS AP market value online, IGRS AP EC search, igrs.ap.gov.in cc, IGRS AP market value, igrs.ap.gov.in login, IGRS AP 2024: EC Search, Stamp & Registration, Market Value, Deed Details, Igrs ap gov in cc ec search, Igrs ap gov in cc online, IGRS online CC, IGRS CC download, Online CC AP, IGRS AP CC download PDF, registration.ap.gov.in ec, Igrs ap gov in cc status, IGRS AP 2024 Registration, IGRS AP Market Value, IGRS AP Deed Details, IGRS AP 2025 Stamp Charges,

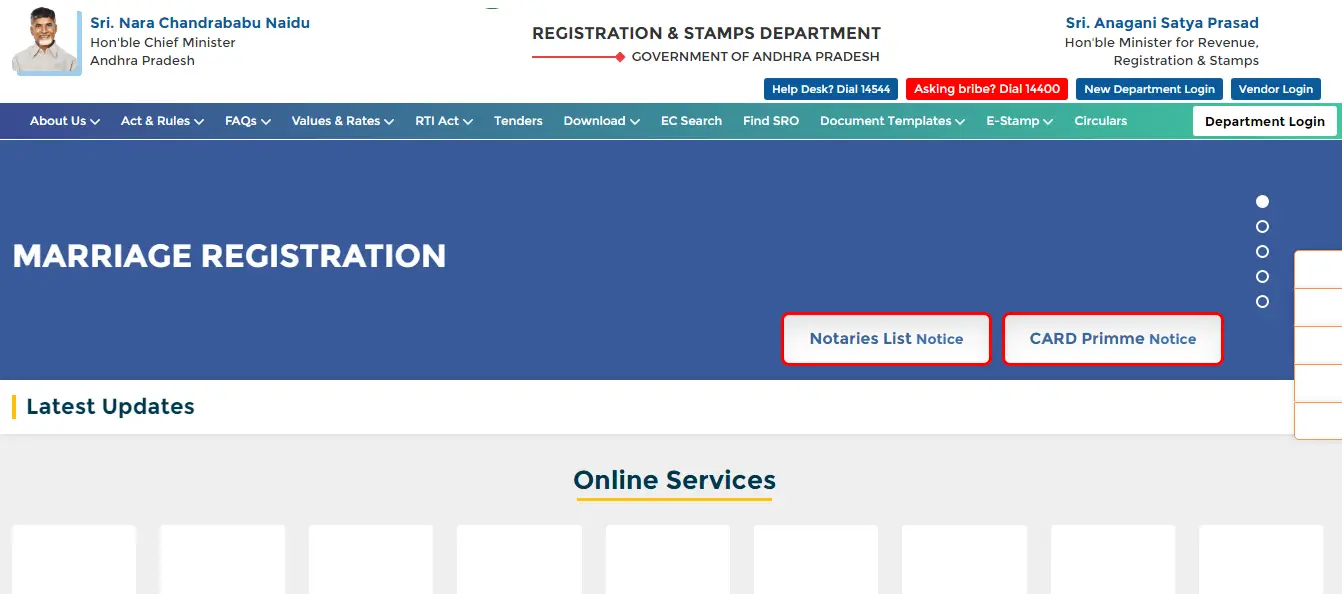

The Registration and Stamps Department (IGRS AP) is the oldest department in the state of Andhra Pradesh, established with the objective of validating registered documents. This department plays a crucial role in the property registration process by collecting registration fees and stamp duty. Stamp duty is a compulsory charge levied by the state government on the sale or transfer of real estate. Additionally, when there is a transfer of ownership of immovable property, a registration fee is also applied during the registration of the property. Read the article below to learn more about IGRS AP.

Table of Contents

☰ Menu- About IGRS AP 2024

- IGRS Andhra Pradesh Details - Highlights

- Objective of IGRS Andhra Pradesh

- Benefits of IGRS AP Portal

- Services Provided Under IGRS

- IGRS AP Online Services

- AP Stamp Duty and Registration Charges 2024

- Registration Fees

- Stamp Duty Charges

- Documents Required for IGRS AP

- IGRS AP EC Search: How can I obtain an encumbrance certificate?

- Verify EC online on registration.ap.gov.in

- Compute the conveyance deed stamp duty on IGRS AP?

- Note on Stamp Duty Rates

- Basic Requirments for Using IGRS AP

- Reasons for Property On Prohibited List

- Steps to Check Prohibited Properties List on IGRS AP

- How to Obtain Encumbrance Certificate (EC) on IGRS

- Summary of IGRS AP 2024: EC Search, Stamp & Registration, Market Value, Deed Details

About IGRS AP 2024

The Inspector General of Revenue and Stamps Andhra Pradesh (IGRS AP) plays a vital role in generating revenue for the state through stamp tax, registration fees, and transfer duties. Document registration with IGRS is essential, as it ensures that once documents are registered, they become publicly accessible, aiding in their verification. When ownership of immovable property is transferred, a registration fee is charged alongside the stamp duty applied to property transactions. IGRS AP is the oldest department in Andhra Pradesh responsible for certifying the authenticity of registered documents and is often referred to as IGRS Andhra Pradesh.

IGRS Andhra Pradesh Details - Highlights

| Key Points | Details |

|---|---|

| Name | IGRS AP |

| Objective | Provides IGRS EC |

| Beneficiaries | Citizens of Andhra Pradesh |

| Official Website | registration.ap.gov.in |

Objective of IGRS Andhra Pradesh

The objectives of the IGRS AP (Integrated Grievance Redressal System for Andhra Pradesh) are as follows:

- Digital Transformation: IGRS AP aims to digitize property transactions, making it easier for citizens to engage in processes such as property registration, stamp duty payment, and document verification through online platforms.

- Transparency in Records: The portal ensures transparent access to land and property records, including ownership information, encumbrance certificates, and lists of prohibited properties.

- Grievance Resolution: IGRS AP is designed to provide an effective platform for grievance resolution, enabling citizens to lodge complaints and seek solutions for property-related issues.

- Simplification of Property Mutation: One of its key aims is to streamline the property mutation process (Dakhil Kharij), which involves updating ownership records following the sale or inheritance of property.

- Public Accountability: By offering public access to property transactions and records online, IGRS AP fosters accountability among property owners, buyers, sellers, and government officials.

Benefits of IGRS AP Portal

The IGRS AP portal offers numerous advantages to users:

- Convenient Access: Users can access a variety of services from the comfort of their homes, eliminating the need to visit government offices.

- Enhanced Transparency: The portal promotes transparency in land transactions by providing straightforward access to essential land and property records.

- Easy Land Record Search: Users can conveniently search for land records, survey numbers, and ownership information, making the process efficient and user-friendly.

- Access to Encumbrance Certificates: The portal provides access to encumbrance certificates, which are crucial for confirming that a property is free from legal encumbrances or outstanding dues.

- Prohibited Property Information: Users can review the prohibited property list to determine if a specific property is subject to government restrictions or legal disputes.

- Streamlined Online Payments: The portal facilitates online payment of stamp duty and registration fees, streamlining the property registration process and saving users time by removing the necessity for in-person visits to government offices.

Services Provided Under IGRS

- Partition

- Gift

- Agreement of sale cum G.P.A

- Conveyance

- Mortgage

- Release of Benami rights

- Settlement

- Construction/Development agreements

- Sale of immovable property

IGRS AP Online Services

The IGRS AP Online Services offer various tools to assist with property registration and related inquiries:

- List of Exchanges: This feature allows users to check registration details by entering specific information. To access registration details for document numbers, layout plots, or apartments, select the relevant option from the dropdown menu. For plots, you’ll need to specify the village, mandal, and district, followed by entering the survey number, plot number, and a list of survey numbers. For apartments, the process is similar; however, you should input the address, flat number, and house number instead. Click “submit” to view the registration details.

- EC Search: This tool enables users to check for encumbrances on any property registered in Sub-Registrar offices. You can search for an encumbrance certificate by entering either the document number, home number, or survey number, along with selecting the district and SRO office locations to find information specific to Andhra Pradesh.

- Duty Fee Calculator: This online calculator provides guidance on stamp duties and fees. To use it, select the document type from the dropdown menu, enter the consideration value, and specify whether the property has been previously identified. You will then choose the property's category, neighborhood, town, and area. Additional fields such as “boundaries” and “extent” must also be filled out. After selecting the unit from the dropdown, you can calculate the market value and applicable duty fee.

- Verify EC: This service allows you to validate an encumbrance certificate by entering the department transaction ID and clicking “submit” to confirm its authenticity.

AP Stamp Duty and Registration Charges 2024

In India, registration fees and stamp duty are essential components of real estate transactions. The following table lists the Andhra Pradesh stamp and registration:

Registration Fees

| Criteria | Registration Fees |

|---|---|

| Sale deed | 0.5% |

| Gift deed | 0.5% Minimum: INR 1,000 Maximum: INR 10,000 |

| Agreement-cum-general POA | 0.5% Maximum limit: INR 20,000 |

| Sale-cum-general POA | INR 2,000 |

| POA to construct, sell, transfer, develop immovable property | 0.5% Minimum: INR 1,000 Maximum: INR 20,000 |

| Deed of lease | 0.1% |

| Deed of License | 0.1% |

| Deed of Conveyance | 0.5% |

| Mortgage | 0.1% |

Stamp Duty Charges

| Criteria | Stamp Duty Charges |

|---|---|

| Sale of immovable property | 5.00% |

| Sale agreement | 5.00% |

| Development agreement | 5.00% |

| Construction agreement | 5.00% |

| Sale-cum-GPA agreement | 6.00% |

| Sale-cum-GPA development | 1.00% |

| Lease agreement for less than a decade | 0.4% |

| Lease agreement between 10-20 years | 0.6% |

Documents Required for IGRS AP

To complete the registration process through IGRS AP, the following documents are required:

- Passport-size photographs of both the buyer and seller.

- Identity cards, such as Aadhaar Card, Voter ID, or Passport.

- Current property card obtained from the City Survey Department (CSD).

- Registered photocopy of the original sale deed.

- Photocopy of utility bills for verification.

- Photocopy of the valid document confirming the payment of the required stamp duty.

IGRS AP EC Search: How can I obtain an encumbrance certificate?

To obtain an encumbrance certificate (EC) in Andhra Pradesh, follow these steps:

- Visit the Official Website: Go to the website of the Andhra Pradesh government's Registration and Stamps Department.

- Access EC Search: In the “Service” section, select the “Encumbrance Certificate” option. A disclaimer page will appear; click the “Submit” button to proceed.

- Enter Required Information: Fill in the details using the document and memo numbers, as well as the registration year.

- Complete the Form: After entering the information, input the Captcha code and click the submit button.

- View Property Details: The screen will display all relevant details related to the specified property.

Note:

- If you do not have a memo or document number, check the box labeled “none.” A form will be provided; complete it with the applicant’s name, building details, SRO information, land details, and any other required information.

- For properties acquired before 1983, the applicant must visit the sub-registrar’s office (SRO) in person and submit an offline application.

Verify EC online on registration.ap.gov.in

To confirm the authenticity of an encumbrance certificate (EC), follow these steps:

- Visit the IGRS AP Website: Go to the official website at registration.ap.gov.in.

- Select “Verify EC”: Under the “Services” menu, choose the “Verify EC” option.

- Enter Department Transaction ID: Input the department transaction ID in the designated field.

- Submit: Click the “Submit” button to proceed.

- View Results: The final results will be displayed on the screen, confirming the document’s authenticity.

Compute the conveyance deed stamp duty on IGRS AP?

To calculate stamp duty and registration fees for a conveyance deed using IGRS AP, follow these steps:

- Visit the IGRS AP Portal: Go to registration.ap.gov.in.

- Access Duty and Fee Details: Locate the “Duty and Fee Details” widget on the right-hand side of the homepage.

- Select Deed Instrument: Choose the relevant deed instrument to determine the registration and stamp duty amounts.

Note on Stamp Duty Rates

Stamp duty rates in Andhra Pradesh vary based on the type of transfer deed. For example:

- Gift Deed: Subject to 2% stamp duty and 0.5% registration fees, with a maximum cap of Rs 10,000.

- Agreement of Sale: Subject to 5% stamp duty.

Ensure you select the correct deed type to obtain accurate calculations.

Basic Requirments for Using IGRS AP

To utilize the IGRS AP portal effectively, the following basic requirements must be met:

- Online Access: Anyone can use this portal online.

- Familiarity with Technology: Users should have a basic understanding of how to operate computers or mobile devices.

- Property Information: To search for property records, you will need specific details, including the district, plot number, and survey number.

- User Registration: For certain services, you may be required to register on the portal.

Reasons for Property On Prohibited List

Properties may be included on the prohibited list for several reasons:

- Government Acquisition: The land may be earmarked for public projects, including infrastructure development.

- Disputed Ownership: Properties that are involved in legal disputes may face restrictions on their sale or transfer.

- Illegal Constructions: Lands that have been unlawfully occupied or feature unauthorized constructions may be classified as off-limits.

- Reserved for Public Use: Certain properties are designated for community benefits, such as parks, roadways, or other public facilities.

Steps to Check Prohibited Properties List on IGRS AP

To verify whether a property is on the prohibited list, follow these steps:

- Visit the Official Website: Go to igrs.ap.gov.in.

- Access Prohibited Lands: On the homepage, click on the “Prohibited Lands” option.

- Enter Required Information: Input the necessary details, such as district, village, survey number, and any other relevant information.

- Check Property Status: After submitting the information, you can determine if your property is included in the prohibited list or if it is available for sale or transfer.

How to Obtain Encumbrance Certificate (EC) on IGRS

To obtain your Encumbrance Certificate (EC), follow these steps:

- Visit the Official Website: Go to igrs.ap.gov.in.

- Access EC Service: On the homepage, click on “Encumbrance Certificate” under the “Online Services” section.

- Enter Required Details: Fill in the necessary information, including district, sub-registrar office, village, survey number, plot number, and any other relevant details.

- Download Your EC Certificate: After entering the details, you can download your Encumbrance Certificate.

Summary of IGRS AP 2024: EC Search, Stamp & Registration, Market Value, Deed Details

IGRS AP 2024 streamlines property transactions in Andhra Pradesh by offering online services such as EC search, stamp duty calculations, and registration. Users can easily access essential property records, check encumbrance certificates, and make payments without visiting government offices. This digital platform enhances transparency, simplifies the property mutation process, and facilitates grievance resolution, making property management more efficient and user-friendly for citizens.

What is IGRS AP?

IGRS AP stands for the Integrated Grievance Redressal System of Andhra Pradesh, which is a digital platform aimed at facilitating property registration, stamp duty payments, and document verification for citizens.

How can I access the IGRS AP portal?

You can access the IGRS AP portal by visiting registration.ap.gov.in.

What services are available on the IGRS AP portal?

The portal offers various services including encumbrance certificate (EC) search, market value assessments, online payment of stamp duty and registration fees, and access to property records.

How do I download an Encumbrance Certificate (EC) from IGRS AP?

To download an EC, visit the IGRS AP website, select the EC service, enter the required details (like district, document number, etc.), and click submit to view and download your EC.

What is the purpose of an Encumbrance Certificate?

An EC certifies that a property is free from any legal dues or encumbrances, which is crucial for property transactions.

How can I check the market value of a property online?

You can check the market value by using the market value calculator available on the IGRS AP portal, where you need to enter details such as property type, area, and other relevant information.

What documents are required for property registration in IGRS AP?

Required documents include identity proofs (Aadhaar, Voter ID), photographs, a current property card, a photocopy of the original sale deed, and proof of stamp duty payment.

Can I pay stamp duty and registration fees online?

Yes, the IGRS AP portal facilitates online payment of both stamp duty and registration fees through various payment modes.

What are the stamp duty rates in Andhra Pradesh?

Stamp duty rates vary based on the type of property and transaction; for example, the stamp duty on the sale of immovable property is typically 5%.

Is it necessary to register a property?

Yes, registration of property is mandatory in Andhra Pradesh to ensure legal recognition and protect the interests of property owners.

What is the process to verify the authenticity of an EC?

To verify an EC, visit the IGRS AP website, select the “Verify EC” option, enter the department transaction ID, and submit to check its authenticity.

How can I check if a property is on the prohibited list?

You can check the prohibited properties list by selecting the "Prohibited Lands" option on the IGRS AP portal and entering the required details like district and survey number.

What should I do if I face issues while using the IGRS AP portal?

If you encounter any issues, you can lodge a grievance through the online grievance redressal system available on the portal or contact customer support.

How do I compute the stamp duty for a conveyance deed?

You can compute the stamp duty by accessing the Duty Fee Calculator on the IGRS AP portal and entering the necessary details about the property and transaction.

Can I use IGRS AP services without registering on the portal?

Most services can be accessed without registration; however, certain functions may require you to create an account on the IGRS AP portal for enhanced services.

Telegram

Telegram

Comments Shared by People