Delhi Mukhyamantri Swavalamban Rojgar Yojana 2025: Apply Online, Eligibility & Interest Rate

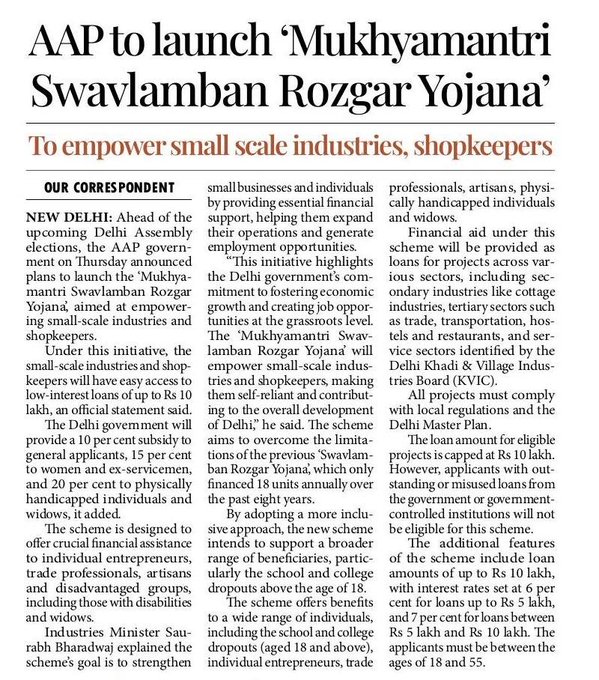

Delhi Chief Minister Swavalamban Rozgar Yojana: The Delhi government has launched the Chief Minister Swavalamban Rozgar Yojana to empower small industries and shopkeepers, providing financial assistance to individuals, entrepreneurs, and marginalized groups, particularly persons with disabilities and widows. The scheme will be implemented through the Delhi Khadi and Village Industries Commission (KVIC), which will act as the nodal agency.

Industry Minister Saurabh Bhardwaj shared details of the scheme, stating that it would help small businesses and individuals expand their operations and create new employment opportunities. He emphasized that this initiative reflects the Delhi government's commitment to boosting economic growth at the grassroots level and creating job opportunities.

Table of Contents

☰ Menu- Delhi Mukhyamantri Swavalamban Rojgar Yojana 2025

- Delhi Swavalamban Rojgar Yojana Details in Highlights

- Eligibility Criteria

- Required Documents

- Benefits of The Swavalamban Rojgar Yojana Delhi

- Key Features of the Scheme

- Interest Rate and Terms

- Subsidy Provision

- Key Elements of the Scheme

- Delhi Mukhyamantri Swavalamban Rojgar Yojana Online Application Process

- Delhi Swavalamban Rojgar Yojana Official Website for Application

- Delhi CM Swavalamban Rojgar Yojana Important Notes

- Conclusion - Swavalamban Rojgar Yojana Delhi Apply Online

Delhi Mukhyamantri Swavalamban Rojgar Yojana 2025

The Delhi Mukhyamantri Swavalamban Rojgar Yojana 2025 aims to make small industries and shopkeepers self-reliant and contribute to the overall development of Delhi. This new initiative addresses the limitations of the previous Swavalamban Rozgar Yojana, which provided annual funding to only 18 units. Under the new scheme, support will be extended to a broader group of beneficiaries, including school and college dropouts aged 18 and above.

Delhi Business Blasters Scheme 2025

Delhi Swavalamban Rojgar Yojana Details in Highlights

| Feature | Details |

|---|---|

| Scheme Name | Delhi Swavalamban Rozgar Yojana |

| Objective | To empower small industries, shopkeepers, entrepreneurs, and marginalized groups (especially persons with disabilities and widows). |

| Implementing Agency | Delhi Khadi and Village Industries Commission (KVIC) |

| Maximum Loan Amount | Up to ₹10 lakh |

| Eligible Beneficiaries | School/College dropouts (18+), individual entrepreneurs, business professionals, artisans, persons with disabilities, widows. |

| Subsidy for General Category | 10% |

| Subsidy for Women, SC/ST & Ex-Servicemen | 15% |

| Subsidy for Persons with Disabilities & Widows | 20% |

| Loan Interest Rates | - 6% for loans up to ₹5 lakh - 7% for loans between ₹5 lakh and ₹10 lakh |

| Loan Terms | - Loans require security and hypothecation - Applicants must be aged 18-55 years. |

| Eligible Sectors | Small/Cottage Industries, Trade, Transport, Hotels & Restaurants, Service Sectors |

| Eligibility for Loan | - No outstanding or inappropriate government loans - Projects should meet the scheme’s guidelines |

| Nodal Agency | Delhi Khadi and Village Industries Commission (KVIC) |

Eligibility Criteria

The Delhi Swavalamban Rozgar Yojana aims to support small industries, shopkeepers, and marginalized groups, offering financial assistance to eligible individuals. Here are the key eligibility criteria for the scheme:

- Age Criteria:

Applicants must be between 18 to 55 years of age at the time of application.

- Beneficiary Groups:

- School and college dropouts (18 years and above).

- Individual entrepreneurs who want to start or expand their businesses.

- Business professionals and artisans.

- Persons with disabilities.

- Widows.

- Ex-servicemen.

- Type of Projects: Applicants must propose projects that fall within eligible sectors such as:

- Small and cottage industries.

- Trade (retail, wholesale).

- Transport.

- Hospitality (hotels and restaurants).

- Service sectors.

- Loan Eligibility:

- The maximum loan amount can be up to ₹10 lakh.

- Projects must meet the guidelines of the scheme and demonstrate the capacity to repay the loan.

- No outstanding or inappropriate loans from government institutions. Applicants with pending or irregular government loans are not eligible.

- Subsidy Eligibility:

- General Category: 10% subsidy on the loan amount.

- Women, SC/ST applicants, and Ex-servicemen: 15% subsidy on the loan amount.

- Persons with disabilities and Widows: 20% subsidy on the loan amount.

- Security Requirements:

- Security and hypothecation are required for securing the loan.

- The loan should be backed by tangible assets or a viable business plan.

- Financial Capacity:

The applicant must be able to demonstrate the financial ability to repay the loan based on the nature of the proposed project.

Note:

- Applicants need to submit all relevant documents as per the scheme’s guidelines, including proof of age, identity, and project details.

- The scheme is aimed at fostering self-sufficiency and job creation, so applicants must propose a sustainable and productive business plan.

These criteria ensure that the scheme reaches the right beneficiaries and helps them establish or expand their ventures.

Delhi Sanjeevani Yojana Apply Online 2025

Required Documents

Here is a list of the required documents to apply for the Delhi Swavalamban Rozgar Yojana:

| Document | Details |

|---|---|

| Identity Proof | Aadhar Card, Voter ID, Passport, or any government-issued ID. |

| Address Proof | Passport, Aadhar Card, Utility Bill (Electricity, Water), Rent Agreement. |

| Age Proof | Birth Certificate, School Leaving Certificate, Aadhar Card, or Passport. |

| Photographs | Passport-sized photographs of the applicant. |

| Bank Account Details | Cancelled cheque or bank passbook copy showing bank details. |

| Project Proposal | A detailed business/project proposal outlining the nature of the business, investment details, and expected outcomes. |

| Educational Qualification | School/College certificates (if applicable). |

| Disability Certificate (if applicable) | For persons with disabilities, a valid certificate issued by a recognized authority. |

| Widow Certificate (if applicable) | Certificate issued by a competent authority confirming widow status. |

| Income Proof | Income Tax Return (if applicable) or any other proof of income. |

| Caste Certificate (if applicable) | For SC/ST applicants, a caste certificate issued by a competent authority. |

| Ex-Servicemen Certificate (if applicable) | Certificate of ex-service status for ex-servicemen applicants. |

| Business Registration Certificate | If the business is already established, the relevant registration certificate. |

| Loan Repayment Proof (if applicable) | Proof of repaid loans (if applying for a loan extension or new loan). |

Ensure that all documents are properly attested and aligned with the scheme’s guidelines for a smoother application process.

Benefits of The Swavalamban Rojgar Yojana Delhi

The Delhi Swavalamban Rozgar Yojana offers several significant benefits aimed at empowering individuals and promoting economic growth in the region. Here are the key benefits:

- Empowerment of Marginalized Groups: The scheme specifically targets marginalized and vulnerable groups, including persons with disabilities and widows, providing them with the opportunity to start or expand their businesses and become self-reliant.

- Financial Assistance for Small and Micro Businesses: The scheme provides financial assistance of up to ₹10 lakh for setting up or expanding small industries, shops, or services, which enables entrepreneurs to develop their businesses and contribute to the local economy.

- Support for Various Sectors: The scheme offers financial assistance across a wide range of sectors, including small and cottage industries, trade, transportation, hospitality (hotels and restaurants), and services, giving a wide array of options for potential beneficiaries.

- Encouragement for Economic Growth: By providing financial assistance to small businesses, the scheme aims to contribute to the overall economic development of Delhi. It helps in creating employment opportunities, reducing poverty, and promoting local industries.

- Promoting Entrepreneurship and Self-Employment: The scheme supports school and college dropouts, artisans, and other individuals to become entrepreneurs, thereby reducing dependency on government jobs and encouraging self-employment.

- Boost to Women and Vulnerable Groups: Special emphasis is placed on women, ex-servicemen, and marginalized communities, offering them higher subsidies and financial assistance to foster their entrepreneurial spirit and create equal opportunities.

- Job Creation: By supporting small businesses and entrepreneurs, the scheme indirectly helps in generating new employment opportunities, thus benefiting the wider community.

- Enhancing the Skill Set of Local Communities: The scheme promotes skill development and self-sufficiency by encouraging individuals to become job creators rather than job seekers, which helps in upskilling local populations.

Overall, the Delhi Swavalamban Rozgar Yojana offers a comprehensive package of financial aid, skill development, and subsidies that empower individuals, promote entrepreneurship, and contribute to the economic development of Delhi.

Delhi Mukhyamantri Mahila Samman Yojana 2025

Key Features of the Scheme

- Diverse Beneficiary Group: The scheme will benefit a wide range of beneficiaries, including school and college dropouts, individual entrepreneurs, business professionals, artisans, persons with disabilities, and widows. This will encourage these groups to become self-sufficient and contribute to the state’s economy.

- Financial Assistance in Various Sectors: Loans under this scheme will be provided for various sectors, including small and cottage industries, trade, transportation, hospitality (hotels and restaurants), and service sectors.

- Loan Limit and Eligibility: The maximum loan limit for eligible projects is up to 10 lakh rupees. However, applicants with outstanding or inappropriate loans from government institutions will not be eligible for this scheme.

Interest Rate and Terms

- Loans up to 5 lakh rupees will have an interest rate of 6%.

- Loans ranging from 5 lakh to 10 lakh rupees will have an interest rate of 7%.

- Security and hypothecation will be required for the loan.

- Applicants must be between 18 and 55 years of age.

Subsidy Provision

- 10% subsidy for general category applicants.

- 15% subsidy for women, SC/ST applicants, and ex-servicemen.

- 20% subsidy for persons with disabilities and widows.

- There is no upper limit on the subsidy for any category.

Key Elements of the Scheme

- Broad beneficiary groups: The scheme will benefit school and college dropouts, individual entrepreneurs, business professionals, artisans, differently abled persons and widows. This will encourage the beneficiaries to become self-reliant and contribute to the state's economy.

- Financial assistance in various sectors: Loans under the scheme will be provided in various sectors such as small or cottage industries, trade, transport, hotels and restaurants and service sectors.

- Loan limit and eligibility: The maximum loan limit for eligible projects will be Rs 10 lakh. However, applicants with unpaid or outstanding loans from government institutions will not be eligible for the scheme.

- Subsidy provision: 10 per cent subsidy will be available for general category applicants, 15 per cent for women, SC/ST and ex-servicemen and 20 per cent for differently abled persons and widows. There will be no upper limit for any category.

- Loan interest rate and terms: The interest rate on loans up to Rs 5 lakh will be 6 per cent and on loans from Rs 5 lakh to Rs 10 lakh will be 7 per cent. Security and hypothecation will be required for the loan. The applicant should be between 18 and 55 years of age.

Delhi Mukhyamantri Swavalamban Rojgar Yojana Online Application Process

- Visit the Official Website: Visit the Delhi Khadi and Village Industries Commission (KVIC) website or the dedicated portal for the Mukhyamantri Swavalamban Rozgar Yojana.

- Register on the Portal: If you are a first-time user, you will need to create a new account. Click on the “Register” button and provide your basic details, such as name, contact information, and Aadhaar number.

- Login to Your Account: Once registered, log in to the portal using your username and password.

- Fill in the Application Form: Complete the application form by entering details about your business, project report, and personal information. Ensure you fill out all required fields accurately.

- Upload Required Documents: Upload scanned copies of all required documents, such as Aadhaar card, project report, proof of age, and any certificates for special categories (e.g., disability, SC/ST, ex-servicemen).

- Submit the Application: After filling out the form and uploading the documents, review the information to ensure everything is correct. Click on the "Submit" button to complete your application.

- Acknowledge Receipt: After submission, you will receive an acknowledgment email or SMS with your application reference number.

- Track Application Status: You can track the status of your application by logging into the portal and using your reference number.

Delhi Swavalamban Rojgar Yojana Official Website for Application

Delhi Khadi and Village Industries Commission (KVIC): www.kvicdelhi.in

Mukhyamantri Swavalamban Rozgar Yojana Portal: Check the official website for any updates on the application process.

Delhi CM Swavalamban Rojgar Yojana Important Notes

- Loan Approval Process: Once your application is reviewed and approved, the loan will be disbursed directly into your bank account.

- Interest Subsidy: The government provides a subsidy on the interest rate, making the loan affordable for small-scale entrepreneurs.

- No Government Loan Defaults: Ensure that you do not have any pending loans with government institutions as it may affect your eligibility.

Conclusion - Swavalamban Rojgar Yojana Delhi Apply Online

The Delhi Mukhyamantri Swavalamban Rozgar Yojana 2025 is an excellent opportunity for small business owners, entrepreneurs, and marginalized groups to secure financial support for their businesses. By providing loans, subsidies, and financial assistance, the scheme aims to promote self-employment and contribute to the economic development of Delhi.

What is the Delhi Mukhyamantri Swavalamban Rozgar Yojana 2025?

The Delhi Mukhyamantri Swavalamban Rozgar Yojana 2025 is a financial assistance scheme aimed at empowering small industries, shopkeepers, and marginalized groups in Delhi. It provides financial support to individuals, entrepreneurs, and communities, especially persons with disabilities and widows, to promote self-employment and economic growth.

Who is eligible to apply for the scheme?

Eligible applicants include:

School/college dropouts (18 years and above)

Individual entrepreneurs, artisans, and business professionals

Persons with disabilities and widows

Ex-servicemen The applicant must be between 18 to 55 years of age and have a viable business plan.

What is the maximum loan amount available under the scheme?

Under the Mukhyamantri Swavalamban Rozgar Yojana 2025, the maximum loan amount is ₹10 lakh for eligible projects.

What types of businesses are eligible for financial assistance?

The scheme supports businesses in various sectors such as:

Small and cottage industries

Trade (retail, wholesale)

Transport

Hospitality (hotels, restaurants)

Service sectors

What are the interest rates on loans?

The interest rates are as follows:

6% for loans up to ₹5 lakh

7% for loans between ₹5 lakh and ₹10 lakh

Is there a subsidy on the loan amount?

Yes, the scheme provides subsidies based on the category:

10% subsidy for general category applicants

15% subsidy for women, SC/ST applicants, and ex-servicemen

20% subsidy for persons with disabilities and widows

What are the eligibility criteria for subsidies?

General category applicants are eligible for 10% subsidy.

Women, SC/ST, and Ex-servicemen are eligible for a 15% subsidy.

Persons with disabilities and Widows are eligible for 20% subsidy.

What documents are required to apply?

Required documents include:

Identity proof (Aadhaar, Voter ID, etc.)

Address proof (Aadhar, Utility Bills, Rent Agreement)

Age proof (Birth certificate, school certificate)

Project proposal (Business plan with investment details)

Bank account details (Cancelled cheque, bank passbook)

Income proof, Disability certificate, Widow certificate (if applicable)

How can I apply for the Delhi Swavalamban Rozgar Yojana 2025?

To apply:

Visit the official Delhi Khadi and Village Industries Commission (KVIC) website.

Register on the portal with your personal details.

Fill in the application form and upload the required documents.

Submit the application and track the status online.

What is the loan repayment process?

The loan must be repaid as per the agreed terms. Applicants will need to submit proof of repayment if applicable. Regular payments are required, and the loan is expected to be repaid within the agreed tenure.

Is there a limit on the subsidy amount?

There is no upper limit on the subsidy for any category, ensuring equitable support for all eligible applicants.

Can I apply for a loan extension under this scheme?

Yes, if you have previously received a loan under this scheme and require an extension, you can apply, subject to approval and compliance with the eligibility criteria.

What happens if I have an outstanding government loan?

Applicants with outstanding or unpaid loans from government institutions are not eligible for the scheme. It is important to ensure that all prior loans are repaid and cleared.

How do I track the status of my application?

After submitting your application, you will receive an acknowledgment with a reference number. You can log in to the portal and use this reference number to check the status of your application.

Where can I find more details about the scheme?

For more detailed information and updates, visit the official website of the Delhi Khadi and Village Industries Commission (KVIC) or the Mukhyamantri Swavalamban Rozgar Yojana portal at www.kvicdelhi.in.

Telegram

Telegram

Comments Shared by People