Bhabishyat Credit Card Scheme (WBBCCS): How to Apply, Interest Rate, Eligibility

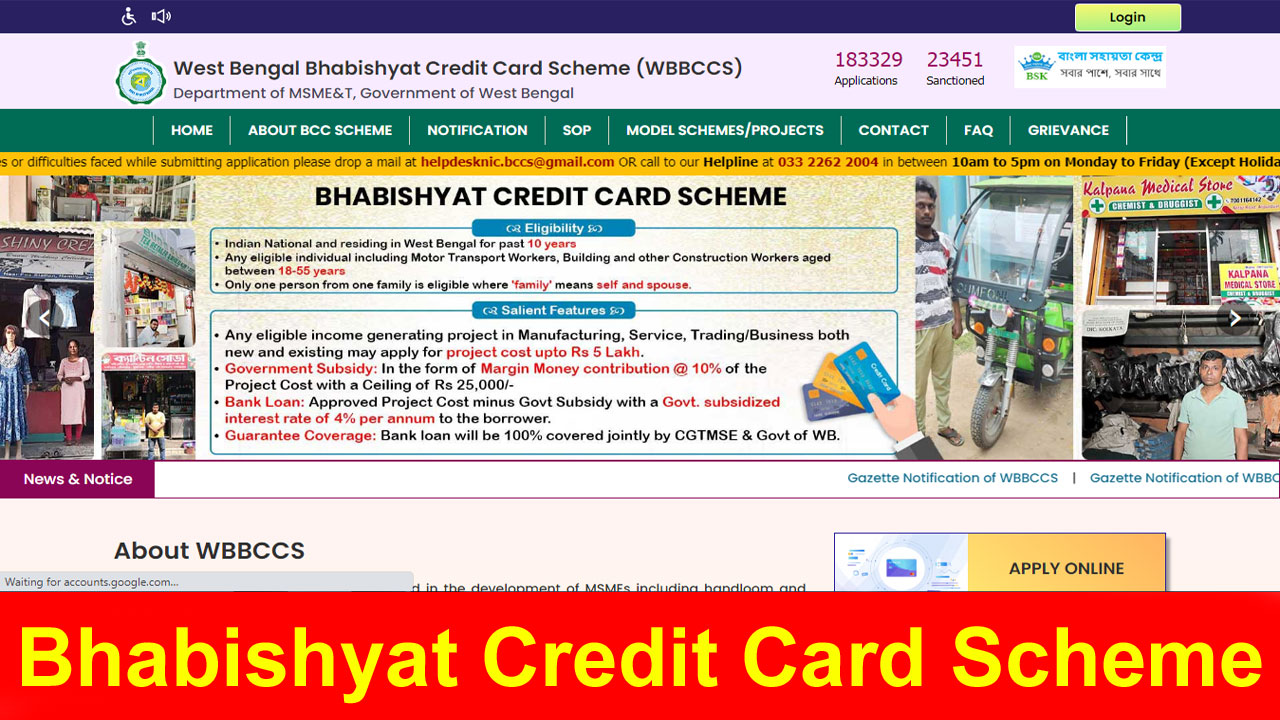

The West Bengal state government has launched an innovative program called the Bhabishyat Credit Card Scheme, aimed at empowering aspiring entrepreneurs. This scheme provides loans of up to ₹5 lakh with a government guarantee, making it an excellent opportunity for individuals planning to start their ventures. Entrepreneurs can apply for this scheme online in 2024 to kickstart their projects. For detailed insights and application steps, explore the information provided below about the Bhabishyat Credit Card Scheme.

Table of Contents

☰ Menu- What is Bhabishyat Credit Card Scheme 2025 ?

- West Bengal Bhabishyat Credit Card Details in Highlights

- Objectives of Bhabishyat Credit Card Scheme 2025

- WBBCCS Features

- Benefits of Bhabishyat Credit Card Scheme

- Documents Required

- Eligibility Criteria for Bhabishyat Credit Card Scheme 2025

- Application Process of Bhabishyat Credit Card Scheme 2025

- Procedure for Offline Applications

- How to Login on BBCS Portal

- Summary of Bhabishyat Credit Card Scheme (WBBCCS)

What is Bhabishyat Credit Card Scheme 2025 ?

The Bhabishyat Credit Card Scheme 2024 is an initiative aimed at fostering self-employment opportunities, especially among the youth. West Bengal, known for its outstanding contributions to the development of MSMEs such as handlooms and handicrafts, has launched this scheme to support budding entrepreneurs. With MSMEs constituting approximately 99% of all industrial undertakings and 98% being micro enterprises, this sector plays a pivotal role in the state’s economy.

The scheme provides credit cards to eligible individuals, enabling them to access financial assistance for starting or expanding their businesses. By leveraging this program, aspiring entrepreneurs can transform their business ideas into profitable ventures with sustainable revenue streams. The Department of Micro, Small, and Medium Enterprises and Textiles (MSME&T), Government of West Bengal, oversees the implementation of this scheme, ensuring targeted support for the growth and development of micro and small-scale enterprises across the state.

West Bengal Bhabishyat Credit Card Details in Highlights

| Scheme Name | Bhabishyat Credit Card Scheme |

|---|---|

| Launched by | West Bengal Government |

| Launched on | April 1, 2023 |

| Department | Department of MSME&T, Government of West Bengal |

| Objective | To provide financial assistance to the state’s citizens |

| Mode | Online |

| Beneficiaries | Young entrepreneurs aged 18 to 55 years old |

| State | West Bengal |

| Official Website | https://bccs.wb.gov.in/ |

Objectives of Bhabishyat Credit Card Scheme 2025

The Bhabishyat Credit Card Scheme 2025 aims to empower educated youth in the state who possess entrepreneurial talent but face challenges in securing institutional credit to meet their financial needs. The scheme focuses on supporting these individuals in establishing microbusinesses, thereby promoting self-reliance. Through this initiative, the government seeks to facilitate self-employment, stimulate income generation, foster wealth creation, and generate additional employment opportunities in both rural and urban areas of the state.

WBBCCS Features

In light of this, a new initiative replaces the "Karmasathi Prakalpa" to support young entrepreneurs between the ages of 18 and 55. The scheme offers subsidy-linked and collateral-free loans for setting up ventures, projects, or micro-enterprises in various sectors, including manufacturing, services, business/trading, and agro-based activities.

To further ease the financial burden, the government provides a Margin Money subsidy along with a subsidized interest rate of 4% per annum on the loan amount for each project, making it more accessible for entrepreneurs to secure financing through banks.

Benefits of Bhabishyat Credit Card Scheme

The Bhabishyat Credit Card Scheme offers several key benefits to its beneficiaries:

- Project Cost Grant: A grant of Rs. 5 lakh is provided to help with the cost of setting up the project.

- Margin Money Subsidy: The government offers a 10% margin money subsidy, alleviating the financial burden on entrepreneurs.

- Subsidy Amount: Each beneficiary receives a maximum subsidy of Rs. 25,000, giving them a significant financial boost for their ventures.

- Bank Loan Calculation: The bank loan is calculated based on the project cost after deducting the government subsidy, which acts as the margin money.

Documents Required

Following are the documents required for scheme.

- Bonafide certificate of West Bengal

- Aadhar card of the applicant

- Copy of ration card

- Business Performa

- Loan documents

- Copy of the PAN card of the applicant

- Recently clicked passport-size photograph

- Contact information, including mobile number

Eligibility Criteria for Bhabishyat Credit Card Scheme 2025

Before applying for the Bhabishyat Credit Card Scheme, candidates must ensure they meet the following eligibility criteria:

- Citizenship: Applicants must be citizens of India.

- Family Enrollment: Only one member per family is eligible to enroll in the program.

- Residency Requirement: Applicants must have been permanent residents of West Bengal for at least ten years.

- Target Group: The scheme is primarily aimed at workers in the construction and motor transport industries aged between 18 and 55 years.

Application Process of Bhabishyat Credit Card Scheme 2025

If you wish to apply for the Bhabishyat Credit Card Scheme, follow the steps below:

- Visit the Official Website: Go to the official website of the Bhabishyat Credit Card Scheme.

- Find the Application Link: Locate the application link for the scheme on the website.

- Access the Application Form: Click on the provided link to access the application form for the scheme.

- Fill in the Details: Download and begin filling in the required information in the application form.

- Provide Accurate Contact Information: Ensure that all your contact details are accurate.

- Attach Required Documents: Attach the necessary documents, including:

- Aadhar Card

- Ration Card

- PAN Card

- Business Proforma

- Loan Documents

- A recent passport-size photo

- Submit the Application: Submit the completed form along with the attached documents to the bank.

- Bank Verification: The bank will verify your eligibility. If approved, you will be issued a credit card with a limit of Rs. 5 lakh.

- Important Reminder: Only one person per household can apply for the scheme, and applicants must have been residents of West Bengal for the last ten years.

Procedure for Offline Applications

Beneficiaries can also apply for collateral-free loans and government-linked subsidies for their business ventures under the Bhabishyat Credit Card Scheme through an offline application process.

- Obtain the Application Form: The offline application form for the West Bengal Bhabishyat Credit Card Scheme is available at the MSME & T Department’s district office.

- Fill out the Application Form: Collect the application form and ensure all the required information is filled out accurately.

- Attach Necessary Documents: Attach the required documents with the application form.

- Submit the Application: Submit the completed application form along with all the necessary documents to the MSME & T Department’s district office.

- Screening Process: The Block/State Level Screening Committee will verify the application forms and supporting documents.

- Loan Processing: Applications that pass the screening process will be forwarded to banks or other financial institutions for the approval of loans.

By following these steps, you can complete the offline application process for the scheme.

How to Login on BBCS Portal

To log in to the Bhabishyat Credit Card Scheme (BBCS) Portal, follow these steps:

- Visit the Official Website: Go to the official portal at https://bccs.wb.gov.in/home.html.

- Locate the Login Option: On the homepage, find the login option in the upper left corner of the screen.

- Open the Login Form: Click on the login link, and a new window will pop up.

- Enter Your Credentials: In the fields provided, enter your username/email/mobile number and password.

- Sign In: Click the "Sign in" button to access your account on the portal.

After logging in, you can manage your application or access other services available on the BBCS portal.

Summary of Bhabishyat Credit Card Scheme (WBBCCS)

The Bhabishyat Credit Card Scheme (WBBCCS), launched by the West Bengal government, provides collateral-free loans up to ₹5 lakh to young entrepreneurs aged 18-55. It aims to foster self-employment by offering financial support for microbusinesses, with a 4% subsidized interest rate and a 10% margin money subsidy. The scheme supports sectors like manufacturing, services, and agro-based industries.

What is the Bhabishyat Credit Card Scheme?

It is a scheme launched by the West Bengal government to provide collateral-free loans up to ₹5 lakh to young entrepreneurs.

Who is eligible for this scheme?

Young entrepreneurs aged 18-55 years, permanent residents of West Bengal for at least 10 years, can apply.

How much loan can I get under this scheme?

The scheme provides a loan amount of up to ₹5 lakh for setting up a business.

What is the interest rate on the loan?

The loan comes with a subsidized interest rate of 4% per annum.

What is the margin money subsidy?

The scheme offers a 10% margin money subsidy to ease the financial burden.

Which sectors are supported under the scheme?

It supports sectors such as manufacturing, services, trading, and agro-based businesses.

Can only one person per family apply for the scheme?

Yes, only one person per family is eligible for enrollment.

How can I apply for the Bhabishyat Credit Card Scheme?

Applications can be submitted online through the official website or offline at the MSME&T Department's district office.

What documents are required to apply?

Required documents include Aadhar card, ration card, PAN card, business proforma, and loan documents.

What happens after I submit my application?

After verification by the bank, if approved, you will be issued a credit card with the loan limit.

Telegram

Telegram

Comments Shared by People