Annasaheb Patil Loan Scheme Online Apply 2024: Check Eligibility & Bank List, Portal Login

The Annasaheb Patil Loan Scheme is an initiative launched by the Annasaheb Patil Economic Development Corporation (APEDC) in 2024, aimed at providing financial support to the economically weaker sections of Maharashtra. This scheme is designed to assist financially unstable citizens and unemployed youth in starting or expanding their businesses. The loans offered under this scheme range from ₹10 lakhs to ₹50 lakhs, catering to a diverse set of entrepreneurial needs.

One of the primary objectives of the scheme is to empower individuals by promoting self-employment and entrepreneurship, ultimately contributing to job creation and economic growth in the state. Eligibility criteria stipulate that applicants must be permanent residents of Maharashtra, with specific age limits of 50 years for males and 55 years for females.

The repayment period for these loans is set at five years, allowing recipients ample time to stabilize their ventures. Required documentation includes an Aadhar card, PAN card, proof of address, an electricity bill, as well as a registered mobile number and email ID. Overall, the Annasaheb Patil Loan Scheme stands as a significant effort to uplift marginalized communities by facilitating access to capital and promoting self-sufficiency.

Table of Contents

☰ Menu- Annasaheb Patil Loan Scheme 2024

- Annasaheb Patil Loan Scheme Details - Key Points

- Objective of Annasaheb Patil Loan Scheme 2024

- Annasaheb Patil Loan Scheme Benefits

- Types of Loans Under the Scheme

- Annasaheb Patil Loan Scheme 2024 Eligibility Criteria

- Annasaheb Patil Loan Scheme Required Documents

- Annasaheb Patil Loan Scheme Online Apply - Step By Step Full Process

- Annasaheb Patil Loan Scheme Bank List

- Annasaheb Patil Loan Scheme Login Process At udyog.mahaswayam.gov.in

- Annasaheb Patil Loan Scheme Contact Number

- Summary of Annasaheb Patil Loan Scheme Apply Online

Annasaheb Patil Loan Scheme 2024

The Annasaheb Patil Loan Scheme is a financial initiative launched by the Annasaheb Patil Economic Development Corporation (APEDC) in Maharashtra to support economically disadvantaged citizens. The scheme offers loans ranging from ₹10 lakhs to ₹50 lakhs, enabling unemployed individuals and small entrepreneurs to start or expand their businesses.

The primary objective is to foster entrepreneurship, create job opportunities, and promote self-sufficiency among the state's residents. Eligibility requires applicants to be permanent Maharashtra residents, with specific age limits set for males and females. The loans come with a repayment tenure of five years, facilitating manageable financial planning for beneficiaries.

Gharkul Yojana Maharashtra Apply Online

Annasaheb Patil Loan Scheme Details - Key Points

| Key Points | Details |

|---|---|

| Name of the Scheme | Annasaheb Patil Loan Scheme 2024 |

| Launched by | Annasaheb Patil Economic Development Corporation (APEDC) |

| Objective | Provide financial assistance to economically weaker citizens of Maharashtra |

| Loan Amount | ₹10 lakhs to ₹50 lakhs |

| Eligibility | Permanent residents of Maharashtra; males up to 50 years; females up to 55 years |

| Repayment Period | 5 years |

| Type of Loans | - Personal Loan Interest Repayment Plan - Group Loan Interest Repayment Scheme - Group Project Loan Scheme |

| Required Documents | - Aadhar Card - PAN Card - Address Proof - Electricity Bill - Email ID - Mobile Number |

| Application Process | Online registration through the Udyog Mahaswayam portal |

| Contact Information | Phone No: 1800-120-8040 |

| Direct Benefit Transfer | Financial assistance transferred directly to the beneficiary's bank account |

Objective of Annasaheb Patil Loan Scheme 2024

The primary objective of the Annasaheb Patil Loan Scheme 2024 is to provide financial assistance to economically weaker and financially unstable citizens of Maharashtra. This initiative aims to empower unemployed youth and individuals by enabling them to start or expand their businesses, thereby fostering entrepreneurship and self-employment. By offering loans ranging from ₹10 lakhs to ₹50 lakhs, the scheme intends to alleviate financial burdens and help beneficiaries establish sustainable sources of income.

Additionally, the program seeks to create job opportunities within the community, contributing to overall economic development in the state. The scheme not only supports individual growth but also encourages a more robust local economy by stimulating business activities and increasing employment rates. Through this financial assistance, the Annasaheb Patil Loan Scheme aspires to uplift marginalized sections of society, enhance their standard of living, and ultimately contribute to the socioeconomic development of Maharashtra.

My Preferred CIDCO Home Scheme Registration & Login

Annasaheb Patil Loan Scheme Benefits

The Annasaheb Patil Loan Scheme offers a range of benefits aimed at empowering economically weaker sections of society in Maharashtra. Here are the key advantages of the scheme:

- Financial Assistance: The scheme provides substantial financial support, with loan amounts ranging from ₹10 lakhs to ₹50 lakhs. This allows beneficiaries to secure the necessary funds to start or expand their businesses.

- Empowerment Through Entrepreneurship: By facilitating loans, the scheme encourages self-employment and entrepreneurship among unemployed youth and financially unstable citizens, helping them become self-reliant and contribute to the local economy.

- Job Creation: As beneficiaries establish or grow their businesses, they not only improve their financial situation but also create job opportunities for others, contributing to the overall employment rate in the state.

- Flexible Repayment Period: The repayment tenure of five years provides borrowers with ample time to manage their finances and pay back the loan without undue stress, enhancing the scheme's accessibility.

- Direct Fund Transfer: The loan amount is directly transferred to the beneficiary's bank account, ensuring a streamlined and efficient disbursement process that reduces delays and enhances transparency.

- Diverse Loan Options: With various loan types available, including personal loans and group project loans, applicants can choose a plan that best suits their needs and circumstances.

- Support for Economic Growth: The scheme not only aims to uplift individuals but also contributes to the broader economic development of Maharashtra by fostering a culture of entrepreneurship and innovation.

The Annasaheb Patil Loan Scheme 2024 is a comprehensive initiative designed to promote financial stability and self-sufficiency among the state's disadvantaged citizens, ultimately leading to a stronger and more resilient economy.

Types of Loans Under the Scheme

The Annasaheb Patil Loan Scheme offers various loan types to cater to different financial needs:

- Personal Loan Interest Repayment Plan: This plan allows individuals to obtain personal loans with flexible repayment options.

- Group Loan Interest Repayment Scheme: This scheme facilitates loans for groups, encouraging collective entrepreneurship.

- Group Project Loan Scheme: Designed for group initiatives, this scheme funds collaborative projects.

Annasaheb Patil Loan Scheme 2024 Eligibility Criteria

To avail of the benefits under the Annasaheb Patil Loan Scheme, applicants must meet specific eligibility criteria:

- Citizenship: The applicant must be a citizen of Maharashtra.

- Age Limit: The maximum age limit for male applicants is 50 years, while female applicants can be up to 55 years old.

Annasaheb Patil Loan Scheme Required Documents

Applicants need to submit several documents to complete the application process:

- Aadhar Card: A valid proof of identity and residence.

- Email ID: For communication and verification purposes.

- Mobile Number: Essential for receiving OTPs and notifications.

- Electricity Bill: To verify the current address.

- Address Proof: Additional documentation to confirm residency.

- PAN Card: Required for financial transactions and identification.

These criteria and documents are essential for ensuring that the scheme reaches those who genuinely need financial assistance.

Annasaheb Patil Loan Scheme Online Apply - Step By Step Full Process

Applying for the Annasaheb Patil Loan Scheme is a straightforward online process. Follow these steps to complete your application:

Step 1: Visit the Official Website

- Go to the official Udyog Mahaswayam website to begin the application process.

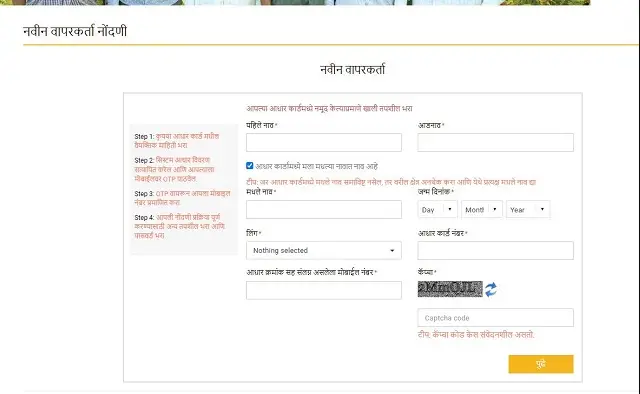

Step 2: Register

- On the home page, click on the "Register Now" option to create your account.

Step 3: Fill Out the Registration Form

- A new page will appear where you need to enter your personal details. This includes:

- Name

- Date of Birth

- Gender

- Aadhar Card Number

- Registered Mobile Number

Step 4: Proceed to Next

- After entering all the required details, click on the "Next" button to move forward.

Step 5: OTP Verification

- Once you click "Next," you will receive a One-Time Password (OTP) on the mobile number you provided.

Step 6: Enter the OTP

- Input the OTP you received on your registered mobile number to verify your identity.

Step 7: Complete the Application

- Now, fill in all other necessary details as prompted. After completing the form, click on the "Submit" button to finalize your application process.

Once submitted, you can check your application status through the same portal, ensuring you stay informed about the progress of your loan application.

Annasaheb Patil Loan Scheme Bank List

Here’s the information about the Annasaheb Patil Loan Scheme banks organized into a table format in English:

| Bank Name | District | Branches by District |

|---|---|---|

| Saraswat Co-op Bank Ltd. | Mumbai | Ahmednagar, Akola, Amravati, Aurangabad, Beed, Buldhana, Mumbai, Mumbai Suburban, Hingoli, Jalgaon, Jalna, Kolhapur, Nagpur, Nashik, Nanded, Parbhani, Pune, Raigad, Ratnagiri, Sangli, Satara, Sindhudurg, Solapur, Thane, Yavatmal, Palghar, Washim |

| Lokvikas Urban Co-op Bank Ltd. Aurangabad | Aurangabad | Aurangabad |

| Shri Virashaiv Co-operative Bank Ltd. Kolhapur | Kolhapur | Sangli, Pune, Mumbai |

| Shri Varna Co-operative Bank Ltd. Varananagar | Kolhapur | Ahmednagar, Pune, Sangli, Mumbai |

| Shri Mahalaxmi Co-operative Bank Ltd. | Kolhapur | Pune, Sangli, Mumbai |

| Kallappanna Awade Ichalkaranji Urban Co-op Bank Ltd. | Kolhapur | Ahmednagar, Aurangabad, Jalna, Sangli, Nashik, Pune, Mumbai, Latur, Solapur, Satara, Ratnagiri, Thane |

| Shri Adinath Co-operative Bank Ltd. Ichalkaranji | Kolhapur | Kolhapur, Sangli |

| The National Co-operative Bank Ltd. | Mumbai | Mumbai, Palghar, Raigad |

| Sindhudurg District Central Co-operative Bank Ltd. | Sindhudurg | Sindhudurg |

| Devgiri Urban Co-operative Bank, Aurangabad | Aurangabad | Buldhana, Jalna, Parbhani, Ahmednagar, Jalgaon, Pune, Thane |

| The Chikhli Urban Co-operative Bank Ltd. Chikhli, Buldhana | Buldhana | Akola, Washim, Aurangabad, Jalna, Nashik, Jalgaon |

| Rajaram Bapu Co-operative Bank Ltd. Peth, Sangli | Sangli | Kolhapur, Pune, Mumbai |

| Thane Janata Co-operative Bank, Thane | Thane | Akola, Nagpur, Aurangabad, Jalna, Latur, Nashik, Sangli, Satara, Solapur, Kolhapur, Raigad, Ratnagiri |

| The Panvel Co-operative Urban Bank Ltd., Panvel | Raigad | Raigad |

| Hutatma Co-operative Bank Ltd., Walwa | Sangli | Kolhapur, Mumbai |

| Raj Vikram Singh Ghatge Co-op. Bank Ltd. Kagal | Kolhapur | Kolhapur |

| Chandrapur District Central Co-operative Bank Ltd. | Chandrapur | Chandrapur |

| Rajapur Urban Co-op. Bank Ltd. Rajapur | Rajapur | Ratnagiri, Sindhudurg |

| Nashik District Women's Co-operative Bank Ltd. | Nashik | Nashik |

| Yavatmal Urban Co-op. Bank Ltd. | Yavatmal | Yavatmal, Ahmednagar, Akola, Amravati, Aurangabad, Chandrapur, Gondia, Jalna, Nanded, Nagpur, Pune, Washim |

| Sharad Urban Co-operative Bank Ltd. | Solapur | Solapur |

| Lokmangal Co-op. Bank Ltd. | Solapur | Solapur |

| Priyadarshini Women's Urban Co-operative Bank | Beed | Beed |

| Palus Co-operative Bank | Sangli | Sangli, Kolhapur, Solapur, Ratnagiri |

| Rameshwar Co-op. Bank Ltd. | Mumbai Suburban | Mumbai Suburban (Borivali) |

| Randal Co-operative Bank Ltd. Randal | Kolhapur | Kolhapur |

| Kurundwad Urban Co-op. Bank Ltd. Kurundwad | Kolhapur | Kolhapur |

| Shri Ambernath Jaihind Co-op. Bank | Thane | Thane |

| Janata Co-operative Bank Amravati | Amravati | Amravati |

| The Amravati Merchant Co-op. Bank Ltd. | Amravati | Amravati |

| Abhinav Urban Co-op. Bank Ltd. | Amravati | Amravati, Nagpur |

| District Central Bank Mumbai | Mumbai | Mumbai, Mumbai Suburban |

| Arihant Co-op Bank | Mumbai Suburban | Mumbai Suburban, Mumbai |

| The Karad Urban Co-op Bank | Satara | Satara, Solapur |

| Vidarbha Merchant Co-op. Bank Ltd., Hinganghat | Wardha | Wardha, Yavatmal, Nagpur, Amravati, Chandrapur |

| The Venkateshwara Co-op. Bank Ltd. Ichalkaranji | Kolhapur | Kolhapur |

| Central Co-op. Bank Ltd. Kolhapur | Kolhapur | Kolhapur |

| Sangli Urban Co-operative Bank Ltd., Sangli | Sangli | Jalna, Parbhani, Beed, Hingoli, Latur, Pune, Solapur, Mumbai City |

| The Bhagyashree Women's Co-operative Bank | Nanded | Nanded |

| Godavari Urban Bank | Nashik | Nashik |

| Shri Narayan Guru Co-op. Bank Ltd. | Mumbai Suburban | Mumbai Suburban, Thane |

| Shri Krishna Co-op. Bank Ltd. | Nagpur | Nagpur |

| Nagpur Urban Co-operative Bank | Nagpur | Nagpur |

| Satara Co-operative Bank | Satara | Satara, Mumbai City, Mumbai Suburban |

| The Hasti Co-op. Bank Ltd. | Dhule | Dhule |

| The Buldhana District Central Co-op. Bank Ltd. | Buldhana | Buldhana |

| Anuradha Urban Co-op. Bank Ltd. | Buldhana | Buldhana |

| Janata Co-operative Bank Ltd. Gondia | Gondia | Gondia, Bhandara, Chandrapur |

| Nishigandha Co-operative Bank | Solapur | Solapur |

| Maharashtra Urban Co-operative Bank Ltd. Latur | Latur | Latur |

| Satara District Central Co-op. Bank Ltd. | Satara | Satara |

| Yes Bank Ltd. | Mumbai | All Districts |

| Raigad Co-operative Bank Ltd. | Mumbai | Raigad, Mumbai |

Annasaheb Patil Loan Scheme Login Process At udyog.mahaswayam.gov.in

To access the Annasaheb Patil Loan Scheme services on the Udyog Mahaswayam portal, follow these steps for a seamless login process:

- Visit the Official Website: Open your web browser and go to the Udyog Mahaswayam portal at udyog.mahaswayam.gov.in.

- Locate the Login Section: On the homepage, look for the "Login" option. This is usually found in the top navigation menu or prominently displayed on the main page.

- Click on Login: Click on the "Login" button to proceed to the login page.

- Enter Credentials: You will be prompted to enter your login credentials. Fill in the following details:

- Username/Email ID: Input the username or email ID you used during registration.

- Password: Enter your password.

- Captcha Verification: If required, complete any captcha verification to confirm that you are not a robot.

- Click on Login: Once you have entered all necessary information, click the "Login" button.

- Access Your Account: After successful login, you will be directed to your account dashboard, where you can access various services related to the Annasaheb Patil Loan Scheme, including application status, loan management, and more.

By following these steps, you can easily log in to the Udyog Mahaswayam portal to manage your Annasaheb Patil Loan Scheme application and access other related services.

Annasaheb Patil Loan Scheme Contact Number

Friends, in this article we have given you information related to Annasaheb Patil Loan Scheme, if you want more information related to Annasaheb Patil Loan Scheme, then in such a situation you can ask by contacting the Annasaheb Patil Loan Scheme contact number given below.

24 x 7 Citizen Call Center - 1800-120-8040

Summary of Annasaheb Patil Loan Scheme Apply Online

The Annasaheb Patil Loan Scheme, initiated by the Annasaheb Patil Economic Development Corporation (APEDC), aims to provide financial assistance to economically unstable citizens of Maharashtra. The scheme offers loans ranging from ₹10 lakhs to ₹50 lakhs, empowering unemployed individuals and aspiring entrepreneurs to start or expand their businesses. Eligible applicants include residents of Maharashtra aged up to 50 years for males and 55 years for females. The repayment period is five years, and required documents include an Aadhar card, PAN card, and proof of address. Applications can be submitted online through the official Udyog Mahaswayam portal.

What is the Annasaheb Patil Loan Scheme?

The Annasaheb Patil Loan Scheme is an initiative by the Annasaheb Patil Economic Development Corporation (APEDC) aimed at providing financial assistance in the form of loans to economically unstable citizens of Maharashtra for starting or expanding their businesses.

Who is eligible to apply for the loan under this scheme?

Eligibility criteria include being a permanent resident of Maharashtra, with a maximum age limit of 50 years for males and 55 years for females.

What is the loan amount offered under the Annasaheb Patil Loan Scheme?

Applicants can avail loans ranging from ₹10 lakhs to ₹50 lakhs, depending on their business needs and project viability.

What types of loans are available under the scheme?

The scheme offers several types of loans, including personal loans, group loan interest repayment plans, and group project loan schemes.

What is the repayment period for the loans?

The repayment period for the loans under the Annasaheb Patil Loan Scheme is set at five years.

What documents are required to apply for the loan?

Applicants must provide an Aadhar card, PAN card, proof of address (such as an electricity bill), mobile number, email ID, and any other relevant documentation as specified during the application process.

How can I apply for the Annasaheb Patil Loan Scheme?

Interested individuals can apply online through the official Udyog Mahaswayam portal by registering and filling out the application form.

How is the loan amount disbursed to the beneficiaries?

Once approved, the loan amount is directly transferred to the beneficiary's bank account for easy access and management.

Can I apply for the loan if I am already a business owner?

Yes, individuals who are already running a business but need financial assistance for expansion or enhancement can apply for the loan under this scheme.

Where can I find more information or assistance regarding the Annasaheb Patil Loan Scheme?

For more information, applicants can visit the official Udyog Mahaswayam portal or contact the APEDC helpline at 1800-120-8040 for assistance with queries or the application process.

Telegram

Telegram

Comments Shared by People