Abhinandan Education Loan Subsidy Scheme Apply Online, Eligibility & Interest Rate

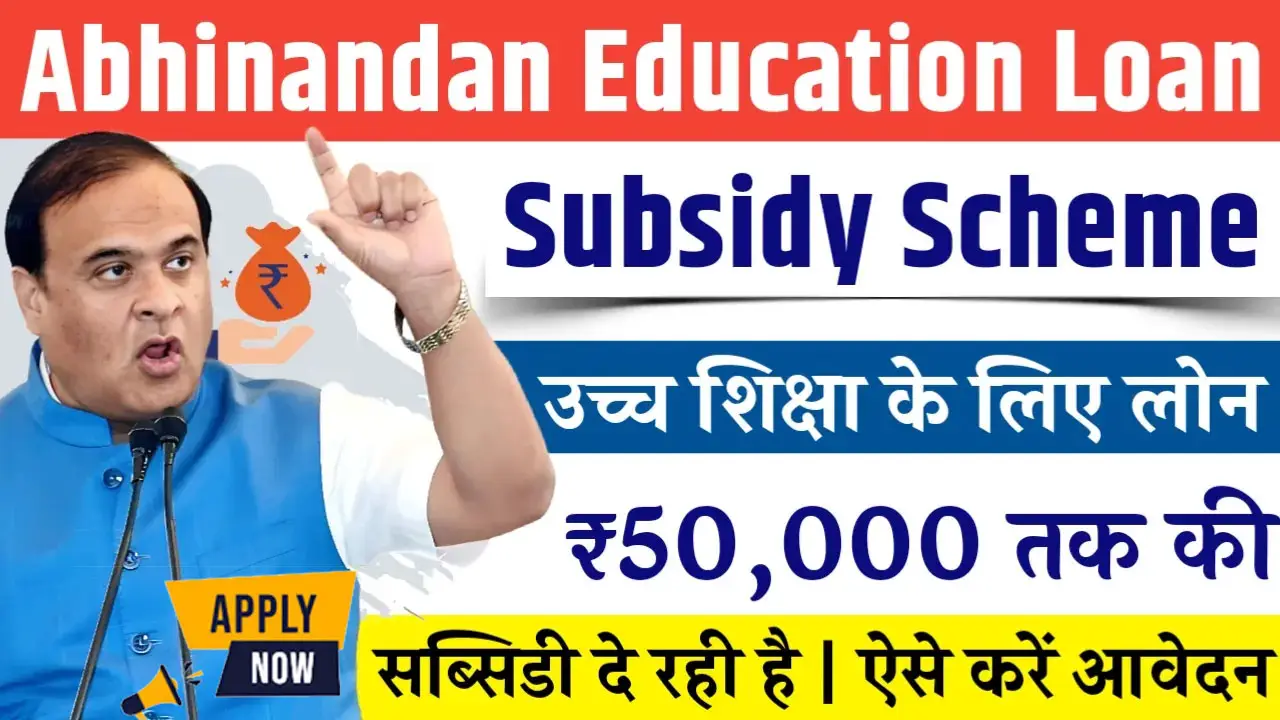

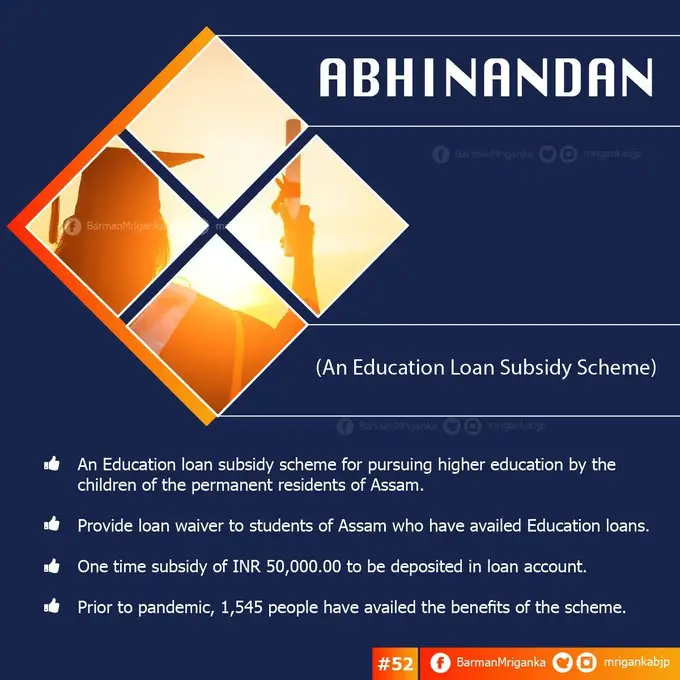

The Abhinandan Education Loan Subsidy Scheme is an initiative by the Government of Assam aimed at supporting students pursuing higher education from reputable institutions. This scheme provides a one-time subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh, thereby alleviating some financial burdens associated with higher studies. It is particularly designed to encourage students to secure loans from commercial banks, including Federal Bank and HDFC, as well as regional rural banks like Assam Rural Regional Bank.

To qualify, applicants must be permanent residents of Assam and must have taken a loan from a recognized bank approved by the Reserve Bank of India. The scheme mandates that students or their families must cover at least 25% of the loan amount to avail the subsidy. Notably, government employees are excluded from eligibility, and students who have already benefited from the Bidya Lakshmi Scheme cannot apply for this subsidy.

This scheme not only provides financial assistance but also aims to promote educational pursuits among the youth of Assam, ensuring that more students can access quality education without overwhelming financial strain. By fostering educational opportunities, the Abhinandan Scheme plays a crucial role in enhancing the educational landscape of the state.

Table of Contents

☰ Menu- Table of Contents

- Assam Abhinandan Education Loan Subsidy Scheme 2024

- Abhinandan Education Loan Subsidy Scheme 2024 - Highlights

- Abhinandan Education Loan Subsidy Scheme 2024 - Key Points

- Objective Of Abhinandan Education Loan Subsidy Scheme 2024

- Benefits Of Abhinandan Education Loan Subsidy Scheme 2024

- Features Of Abhinandan Education Loan Subsidy Scheme 2.0

- Loan Subsidy Amount

- Loan Interest Rate

- Abhinandan Education Loan Subsidy Scheme 2024 Eligibility Criteria

- Exclusions

- Documents Required

- Abhinandan Education Loan Subsidy Scheme Apply Online

- Abhinandan Education Loan Subsidy Scheme 2024: How To Apply Offline

- Abhinandan Education Loan Subsidy Scheme Application Form PDF Download

- Summary of Abhinandan Education Loan Subsidy Apply Online

Assam Abhinandan Education Loan Subsidy Scheme 2024

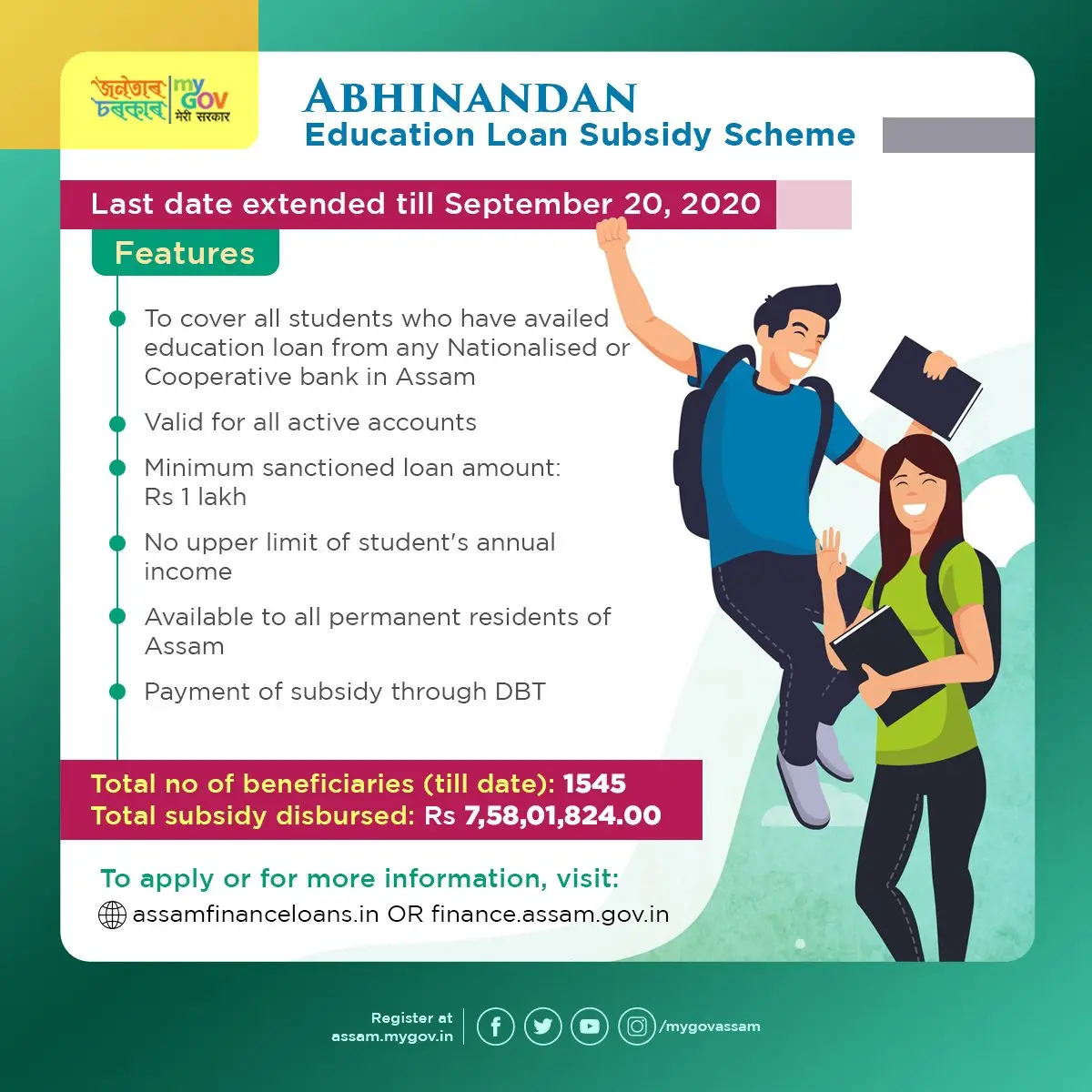

The Abhinandan Education Loan Subsidy Scheme 2024 is a government initiative in Assam designed to support students pursuing higher education from recognized institutions. Under this scheme, eligible students can receive a one-time subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh.

To qualify, applicants must be permanent residents of Assam and secure their loans from approved commercial or rural banks. The scheme requires students to cover at least 25% of the loan amount. However, government employees and those who have already benefited from the Bidya Lakshmi Scheme are ineligible. This initiative aims to encourage educational pursuits among the youth.

Abhinandan Education Loan Subsidy Scheme 2024 - Highlights

Here are the key points of the Abhinandan Education Loan Subsidy Scheme 2024:

- Objective: To provide financial assistance to students pursuing higher education through a one-time subsidy on education loans.

- Subsidy Amount: Eligible students can receive a subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh.

- Eligible Institutions: The scheme is applicable to students attending recognized institutions for higher education.

- Residency Requirement: Applicants must be permanent residents of Assam.

- Loan Sources: The subsidy is applicable to loans from recognized commercial banks, including Federal Bank and HDFC, as well as regional rural banks like Assam Rural Regional Bank.

- Loan Contribution: Students must contribute at least 25% of the loan amount to qualify for the subsidy.

- Exclusions: Government employees are not eligible, and beneficiaries of the Bidya Lakshmi Scheme cannot apply for this subsidy.

- Application Process: Students can apply online through the official website by submitting the required documents, including Aadhaar, parent identification, bank loan documents, and residence certificate.

Abhinandan Education Loan Subsidy Scheme 2024 - Key Points

| Scheme Name | Abhinandan Education Loan Subsidy Scheme 2.0 Assam |

|---|---|

| Objective | Provide financial assistance through a subsidy on education loans for higher education. |

| Subsidy Amount | Up to ₹50,000 on education loans exceeding ₹1 lakh. |

| Eligible Institutions | Recognized institutions for higher education. |

| Residency Requirement | Permanent residents of Assam. |

| Loan Sources | Loans from approved commercial banks (e.g., Federal Bank, HDFC) and regional rural banks. |

| Loan Contribution | Students must contribute at least 25% of the loan amount. |

| Exclusions | Government employees and beneficiaries of the Bidya Lakshmi Scheme are ineligible. |

| Application Process | Apply online via the official website; submit required documents (Aadhaar, bank loan documents, residence certificate). |

Objective Of Abhinandan Education Loan Subsidy Scheme 2024

The objective of the Abhinandan Education Loan Subsidy Scheme 2.0 is to provide financial assistance to students in Assam who are pursuing higher education from recognized institutions. By offering a one-time subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh, the scheme aims to alleviate the financial burden on students and their families.

This initiative encourages students to secure loans from commercial and regional rural banks, thus promoting educational opportunities and enhancing access to quality education. Ultimately, the scheme seeks to empower the youth of Assam, fostering a more educated and skilled workforce in the state.

Benefits Of Abhinandan Education Loan Subsidy Scheme 2024

The Abhinandan Education Loan Subsidy Scheme 2024 offers several benefits to students pursuing higher education in Assam:

- Financial Assistance: Provides a one-time subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh, helping to reduce the financial burden on students and their families.

- Encouragement for Higher Education: Promotes higher education by making it more affordable, encouraging students to pursue degrees from recognized institutions.

- Loan Accessibility: Facilitates access to education loans from approved commercial banks (e.g., Federal Bank, HDFC) and regional rural banks, ensuring students have various financing options.

- Reduced Loan Repayment Burden: The subsidy helps lower the overall repayment amount, making it easier for students to manage their finances post-education.

- Support for Permanent Residents: Specifically benefits permanent residents of Assam, ensuring that local students have access to educational opportunities.

- Encouragement of Bank Loans: Motivates students to take education loans, thereby promoting a culture of borrowing for educational purposes, which can lead to improved career prospects.

- Simplicity in Application: The application process is straightforward, allowing students to apply online and submit necessary documentation with ease.

- Empowerment of Youth: Aims to enhance the skill set of the youth in Assam, contributing to the overall development of the state by creating a more educated workforce.

Features Of Abhinandan Education Loan Subsidy Scheme 2.0

The Abhinandan Education Loan Subsidy Scheme 2024 comes with several notable features designed to support students in Assam pursuing higher education:

- Subsidy Amount: Offers a one-time subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh, directly reducing the financial burden on students.

- Eligibility Criteria: Specifically targets permanent residents of Assam who are pursuing higher education in recognized institutions, ensuring that local students benefit from the scheme.

- Loan Source Flexibility: The scheme covers loans from a variety of financial institutions, including major commercial banks like Federal Bank and HDFC, as well as regional rural banks, providing multiple options for students to secure financing.

- Minimal Contribution Requirement: Students are required to contribute only 25% of the loan amount, making it more accessible for those seeking financial assistance.

- Online Application Process: Facilitates a straightforward online application process through the official website, allowing students to easily apply for the subsidy and submit necessary documents.

- Financial Inclusion: Aims to promote financial inclusion by encouraging students to take education loans, thus fostering a culture of borrowing for educational advancement.

- Exclusions for Specific Groups: Clearly defines exclusions, such as government employees and beneficiaries of the Bidya Lakshmi Scheme, ensuring that the subsidy is targeted towards those who have not already received similar benefits.

- Support for Loan Repayment: Helps reduce the overall amount that students need to repay on their education loans, contributing to better financial management post-graduation.

- Promotion of Higher Education: Encourages students to pursue higher studies, thereby enhancing their skill sets and career prospects, which ultimately contributes to the socio-economic development of Assam.

Loan Subsidy Amount

Under the Abhinandan Education Loan Subsidy Scheme 2024, the loan subsidy amount is as follows:

- Subsidy Amount: Eligible students can receive a one-time subsidy of up to ₹50,000 on education loans that exceed ₹1 lakh.

This subsidy is aimed at alleviating some of the financial burdens associated with pursuing higher education and encourages students to secure loans from recognized banks.

Loan Interest Rate

Education Loan in Assam Interest Rate: The Abhinandan Education Loan Subsidy Scheme 2024 does not specify a fixed interest rate for the education loans covered under the scheme. Instead, the interest rate is determined by the individual banks or financial institutions from which the students secure their loans.

Typically, the interest rates on education loans vary depending on factors such as:

- The lending bank or financial institution (e.g., Federal Bank, HDFC, etc.)

- The type of loan (e.g., secured vs. unsecured)

- The borrower's creditworthiness

- The prevailing market rates

Students are encouraged to check with the respective banks for their specific interest rates and any additional terms or conditions that may apply to their education loans. The scheme primarily focuses on providing a subsidy to help with the overall loan repayment rather than dictating specific loan terms.

Abhinandan Education Loan Subsidy Scheme 2024 Eligibility Criteria

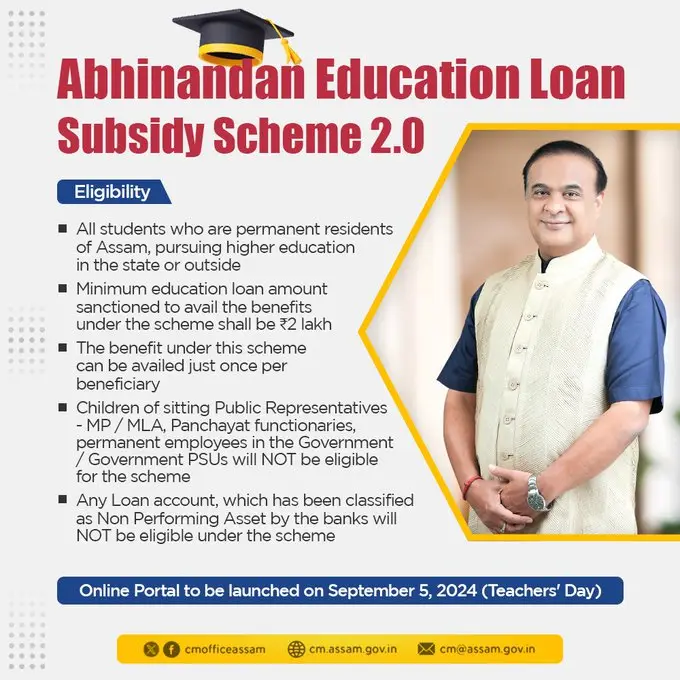

The eligibility criteria for the Abhinandan Education Loan Subsidy Scheme 2.0 are as follows:

- Permanent Residency: The applicant must be a permanent resident of Assam.

- Loan Amount: The student must have taken an education loan of more than ₹1 lakh from a recognized commercial bank or regional rural bank.

- Approved Financial Institutions: The loan must be obtained from banks that are recognized by the Reserve Bank of India (RBI). This includes major commercial banks and regional rural banks, such as Federal Bank and HDFC.

- Educational Purpose: The loan should be specifically for pursuing higher education at recognized institutions.

- Contribution Requirement: Students must contribute at least 25% of the total loan amount to qualify for the subsidy.

Exclusions:

- Government employees are not eligible to apply.

- Students who have already benefited from the Bidya Lakshmi Scheme are not eligible for this scheme.

These criteria ensure that the subsidy reaches the intended beneficiaries, encouraging students from Assam to pursue higher education without overwhelming financial burdens.

Exclusions

Here are the exclusions for the Abhinandan Education Loan Subsidy Scheme 2024:

- Government Employees: Individuals who are government employees are not eligible to apply for this scheme.

- Multiple Benefits: Students receiving benefits under this scheme are not allowed to avail of benefits from any other scheme for the same purpose. This ensures that the subsidy is targeted and not duplicated.

- Previous Beneficiaries: Students who have already benefited from the Bidya Lakshmi Scheme are ineligible to apply for the Abhinandan Education Loan Subsidy Scheme.

These exclusions are in place to ensure that the scheme effectively supports its intended beneficiaries without overlap with other financial assistance programs.

Documents Required

To apply for the Abhinandan Education Loan Subsidy Scheme 2024, applicants need to submit the following documents:

- Student's Aadhaar Card: A valid Aadhaar card for identity verification.

- Parent Identification Documents: Identification proof for the student's parents, which could include Aadhaar cards, voter ID, or other government-issued IDs.

- Bank Loan Documents: Documentation related to the education loan, including loan sanction letters and any agreements with the lending bank.

- Residence Certificate: A certificate proving the applicant's permanent residency in Assam.

These documents are essential for verifying eligibility and processing the application for the subsidy effectively. It’s advisable to ensure that all documents are complete and accurate to avoid any delays in the application process.

Abhinandan Education Loan Subsidy Scheme Apply Online

The application process for the Abhinandan Education Loan Subsidy Scheme 2024 is straightforward and can be completed either online or offline. Here’s a step-by-step guide for the online application:

- Visit the Official Website: Go to the official website of the Abhinandan Education Loan Subsidy Scheme.

- Navigate to Application Section: Look for the section related to the "Abhinandan Education Loan Subsidy" on the homepage.

- Click on the Apply Option: Select the option to apply for the scheme.

- Fill Out the Application Form: The online application form will appear. Fill in the required details accurately, including personal information, loan details, and educational background.

- Upload Required Documents: Attach all necessary documents.

- Review and Submit: Double-check all the information provided for accuracy. Once confirmed, submit the application form.

- Confirmation: After submission, you may receive a confirmation notification or reference number for tracking your application status.

Abhinandan Education Loan Subsidy Scheme 2024: How To Apply Offline

- Obtain the Application Form: Visit the nearest bank that is part of the scheme or the relevant government office to collect the application form.

- Complete the Form: Fill out the application form with all the required details.

- Attach Required Documents: Include copies of the necessary documents as listed above.

- Submit the Application: Submit the completed form along with the documents at the designated bank or office.

- Keep a Copy: Retain a copy of the submitted application and documents for your records.

By following these steps, applicants can successfully apply for the Abhinandan Education Loan Subsidy Scheme and receive the financial support needed for their higher education.

Abhinandan Education Loan Subsidy Scheme Application Form PDF Download

To download the Abhinandan Education Loan Subsidy Scheme Application Form PDF, you can follow these steps:

- Visit the Official Website: Go to the official website of the Government of Assam or the specific portal for the Abhinandan Education Loan Subsidy Scheme.

- Locate the Application Form Section: Look for a section labeled "Downloads," "Forms," or "Application Form" related to the Abhinandan Education Loan Subsidy Scheme.

- Download the PDF: Find the link to the Application Form PDF and click on it to download. The form is usually available in PDF format for easy printing and submission.

- Save and Print: Save the PDF to your device and print a copy to fill out your application manually.

If you have trouble finding the form on the official website, you may also inquire at local banks that participate in the scheme or contact relevant government offices for assistance.

Summary of Abhinandan Education Loan Subsidy Apply Online

The Abhinandan Education Loan Subsidy Scheme 2024 aims to support students in Assam pursuing higher education by providing a one-time subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh. Eligible applicants must be permanent residents of Assam and secure loans from recognized banks, contributing at least 25% of the loan amount. The scheme encourages students to pursue higher education without overwhelming financial burdens. However, government employees and beneficiaries of the Bidya Lakshmi Scheme are excluded from eligibility. The application process is accessible both online and offline, making it convenient for students to apply for financial assistance.

What is the Abhinandan Education Loan Subsidy Scheme?

It is a government initiative in Assam that provides a subsidy of up to ₹50,000 on education loans exceeding ₹1 lakh for students pursuing higher education.

Who is eligible to apply for the scheme?

Permanent residents of Assam who have taken education loans from recognized commercial or rural banks are eligible.

What is the maximum subsidy amount available?

The maximum subsidy amount is ₹50,000 for loans exceeding ₹1 lakh.

How much of the loan amount do students need to contribute?

Students must contribute at least 25% of the total loan amount to qualify for the subsidy.

Which banks are recognized under the scheme?

The scheme includes all major commercial banks and regional rural banks recognized by the Reserve Bank of India, such as Federal Bank and HDFC.

Can government employees apply for the scheme?

No, government employees are excluded from applying for this subsidy.

Are beneficiaries of the Bidya Lakshmi Scheme eligible?

No, students who have already benefited from the Bidya Lakshmi Scheme cannot apply for the Abhinandan scheme.

What documents are required to apply?

Required documents include the student’s Aadhaar card, parent identification documents, bank loan documents, and a residence certificate.

How can I apply for the subsidy?

Applications can be submitted online through the official website or offline by visiting participating banks or government offices.

Is there an online application form available?

Yes, the application form is available for download on the official website of the scheme.

What is the purpose of the subsidy?

The subsidy aims to reduce the financial burden on students pursuing higher education and encourage more individuals to secure loans for their studies.

Can I avail benefits from multiple schemes for the same purpose?

No, beneficiaries of this scheme cannot avail benefits from any other scheme for the same purpose.

How is the subsidy disbursed?

The subsidy amount is typically credited directly to the bank account associated with the education loan.

What should I do if my application is rejected?

If your application is rejected, you can contact the relevant authorities for clarification and check if you can reapply after addressing any issues.

Where can I find more information about the scheme?

For more details, you can visit the official website of the Government of Assam or contact local banks participating in the scheme.

Telegram

Telegram

Comments Shared by People